In this analysis, the Football Benchmark team of KPMG Sport Practice focuses on the attendances of some of the fastests football markets globally – the United States, China and India – and compares them to the 'big five' European leagues.

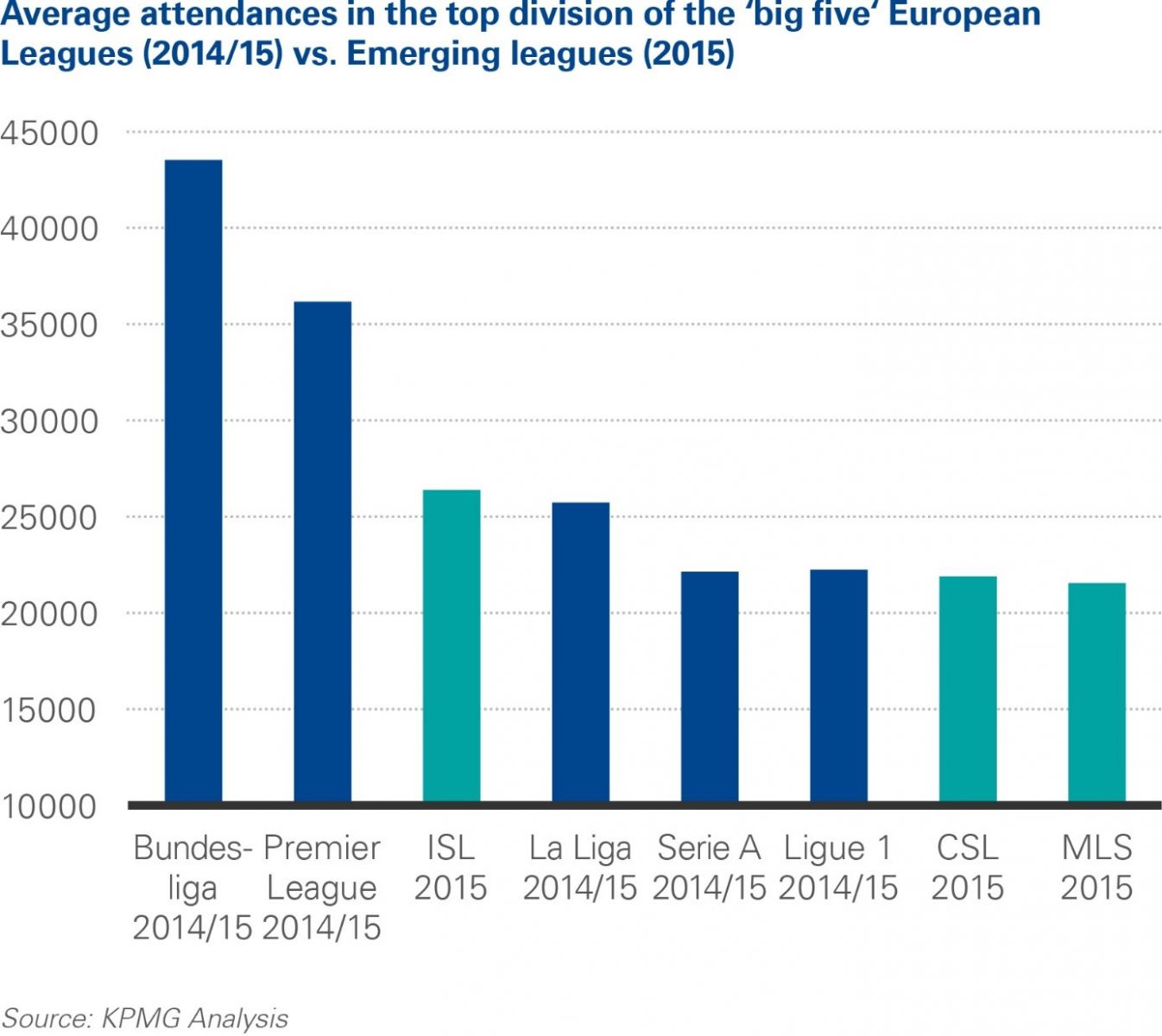

Unlike traditional European leagues, the Major League Soccer (MLS), Indian Super League (ISL) and Chinese Super League (CSL) follow a calender-year season. According to data from the recently finished 2015 season, all three newer competitions surpassed 20,000 in terms of average attendance. Although still far behind the Bundesliga and Premier League, such achievements have put these emerging leagues on a par with the likes of La Liga, Serie A and Ligue 1.

With an average crowd of 21,536 spectators, the MLS’s 20th season broke its own previous attendance record from the 2014 season with year-on-year growth of 12.8%. The addition of two new successful franchises – New York City FC and Orlando City – whose attendance figures are already only just behind the unrivaled Seattle Sounders (44,247), has been the main driver in the increased number of fans at North American stadia. At the same time, the absence of Chivas USA, which recorded the lowest attendance over the previous three seasons, has also positively impacted attendance figures. Although our analysis may be biased simply by the team composition of MLS, it is important to highlight that even if these three clubs had not been considered in our calculations, an overall growth close to 4% would still have been observed.

Although it has enjoyed less recent attention from the international press, the Chinese Super League has experienced the highest growth in average attendance of all the analyzed competitions. A 16.7% increase compared to the 2014 season confirms that not only sponsors and investors but also supporters have recovered their confidence in the local competition. This big leap forward in 2015 has allowed the CSL to reach an average attendance above 21,800, just a few hundred spectators fewer than that of Italy’s Serie A and France’s Ligue 1.

Another promising, yet still young competition, is the Indian Super League. Although it is a less extensive competition – 8 clubs and a total of 56 regular season matches – which has recently completed only its second season, it has already far out-paced the previously existing I-League in terms of crowds. Despite representing only a 4% year-on-year growth compared to its inaugural season, the ISL’s 2015 average crowd (26,376) is above La Liga figures for the 2014/15 season. Furthermore, the ISL has consolidated its position as the domestic Asian competition with the highest average attendance. One factor positively affecting this result is the fact that India’s limited number of franchises are strategically based in regions where football already enjoys a relatively higher popularity, such as Kerala, Goa and North-Eastern India.

An analysis of the evolution of average attendances across the selected countries over the last three equivalent seasons – with 2012 for emerging leagues and 2011/12 for European leagues as a reference – suggests different trends when we compare the newer fast-growing leagues with leagues of some traditional football nations (100% implying neither growth nor decline).

Of the ‘big five’, France’s Ligue 1 has been the only top division to grow at a pace comparable to MLS and CSL recently (17.9% growth over the 2011/12 season). In the 2014/15 season, La Liga and Serie A recorded average attendances of only 98.8% and 95.4% compared to the 2011/2012 campaign. The Bundesliga, with 42,700 spectators on average and an average stadium utilization exceeding 90% and the Premier League, averaging 36,000 spectators and 96% stadium utilization, currently remain by far the top performing leagues in terms of attendance.

The increasing popularity generated by the arrival of internationally recognized players and managers, combined with the growing interest of sponsors and availability of unutilized capacity at certain venues confirms that the MLS, CSL and ISL are likely to see attendance figures grow over the coming seasons. The fast growth of these new football markets raises the question of if these emerging leagues will be able to match the Bundesliga and Premier League attendance in the years to come.

The Football Benchmark Team of KPMG Sport Practice can undertake further analysis of football industry data for you. The subject matter experts within the group can also assist stakeholders to assess and interpret the potential impact on their organisations suggested by the results of particular pieces of research and to identify reasons why a specific trend is being observed or to assess potential solutions and future scenarios.