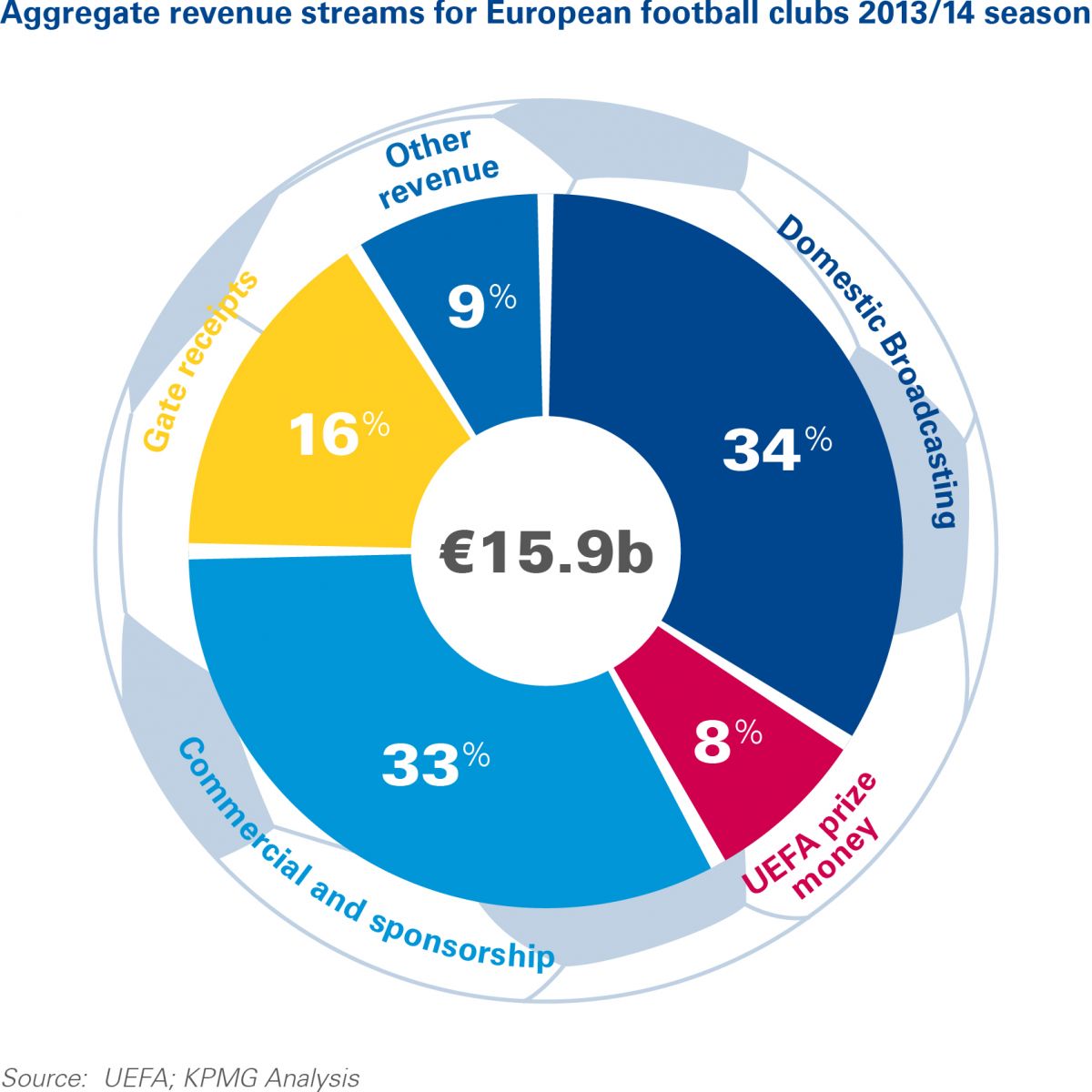

According to UEFA, the 696 football clubs competing in the top divisions of the 54 UEFA member associations generated EUR 15.9 billion revenue in the 2013/14 season. In the five years since 2008/09 revenue has grown by 36%.

As shown in the chart above, revenues are divided into five main streams. The highest revenue increases in absolute terms at European level are generated in two areas: commercial and sponsorship; and broadcasting. Each registering around 45% growth over the five year period analysed.

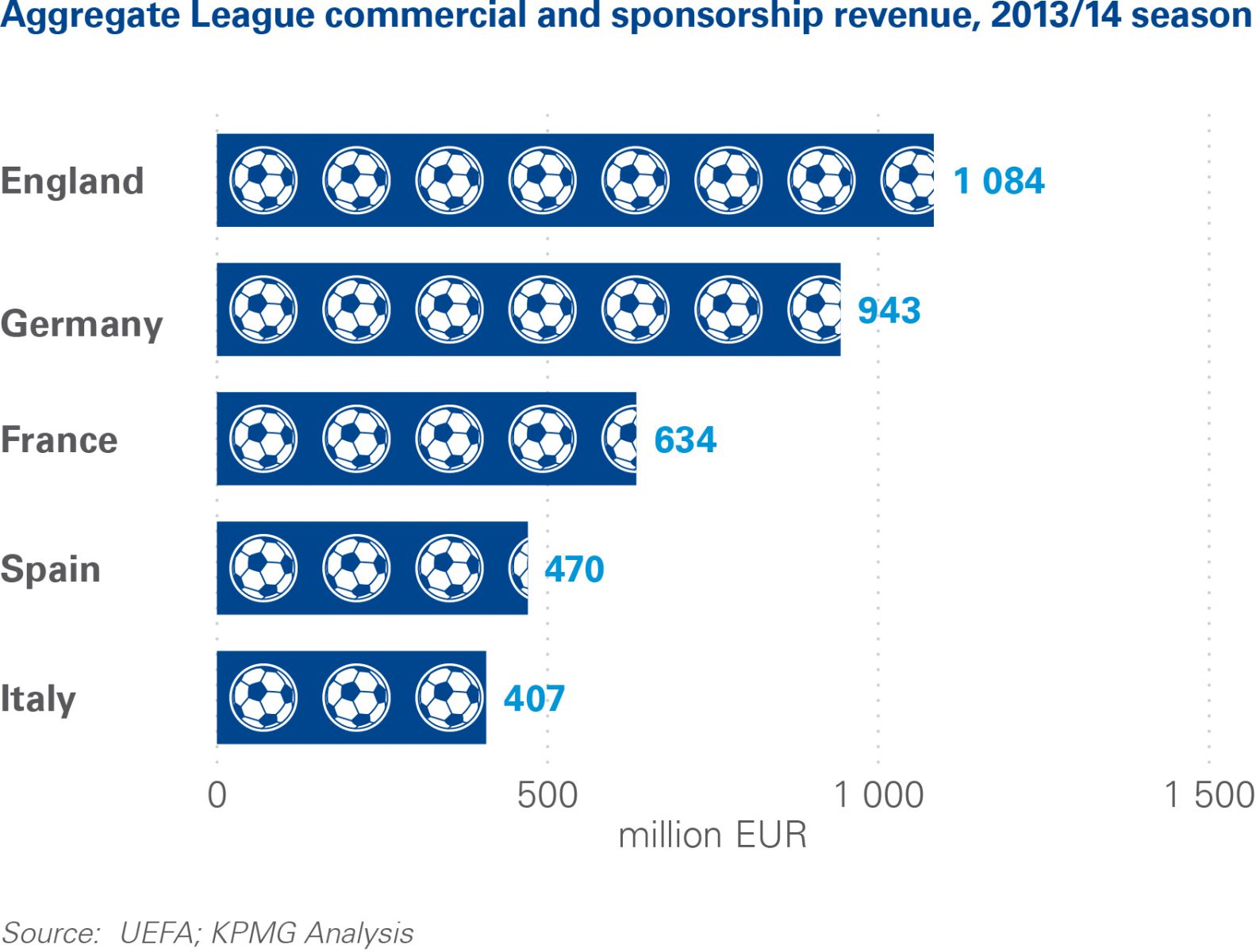

Further investigation of the EUR 5.3 billion commercial and sponsorship figure illustrates the growing polarisation of revenues in football.

The ‘big five’ leagues of England, France, Germany, Italy and Spain account for two thirds of total European commercial and sponsorship income. In fact, only England and Germany together represent 57% of the total aggregated amount for these five leagues and almost 40% of the overall European commercial and sponsorship “income pie”.

An example of such polarisation within one league is the English Premier League. Five clubs - Manchester United FC, Manchester City FC, Chelsea FC, Liverpool FC and Arsenal FC - all have commercial and sponsorship income in excess of EUR 100 million and account for over 50% of the total for the league. Manchester United FC on their own, with such commercial income of approximately EUR 226 million, generate 21% of the Premier League’s total.

The club has been successful in monetising its brand worldwide over the last decade. In addition, the club has signed deals with several multinational companies for their shirt and kit sponsorship rights. The latest shirt sponsorship deal with car manufacturer General Motors is reportedly worth EUR 67 million per year, eclipsing the previous deal with the American insurance company AON (reportedly worth around EUR 25 million per year). The club has retained AON, with an agreement for AON to sponsor the club’s training kit and stadium until 2020/21 for approximately EUR 24 million a year. Furthermore, from the start of the 2015/16 season Adidas replaced Nike as the club’s kit supplier in a deal worth a reported EUR 107 million per year (compared to the previous deal worth approximately EUR 35 million per year). This deal is reported to be the highest kit sponsorship ever signed by any football club.

Across the other ‘big five’ leagues there are individual examples of polarisation within leagues:

- In Germany, FC Bayern Munich’s commercial and sponsorship income of EUR 292 million in 2014 represents almost one third of the total commercial revenue of Bundesliga I. Since 2009, the club’s commercial income has gone up by 83%. By contrast, Borussia Dortmund (EUR 140 million) and FC Schalke 04 (EUR 110 million) earn approximately two or three times less than FC Bayern Munich from this revenue category.

- In France, with around EUR 328 million earned in 2013/14, Paris Saint-Germain FC are the leading club in terms of commercial and sponsorship income. The Paris team accounted for more than half of total French Ligue 1 commercial and sponsorship income in 2013/14.

- Spain’s La Liga is dominated by Real Madrid CF and FC Barcelona, who together account for approximately 90% of La Liga’s total commercial and sponsorship income. Besides new and more lucrative sponsorship deals, both clubs have been able to capitalise on two key factors: i) domestic and European on-pitch success, and ii) global fan base generation, with both clubs having over 80 million Facebook followers, the highest of all football clubs.

Together, the five clubs mentioned above – Manchester United FC, FC Bayern Munich, Paris Saint-Germain FC, FC Barcelona, and Real Madrid CF – which are less than 1% of the clubs in the top divisions of all 54 UEFA member associations, accounted for 24% of the whole European market in terms of commercial and sponsorship income in 2013/14.

Italy is at the bottom of the ‘big five’ in terms of commercial and sponsorship income, seeing on aggregate EUR 407 million in the 2013/14 season, with AC Milan (EUR 98 million) being the highest revenue generators from this income source, despite limited on-pitch success over the past four seasons. Whilst Juventus FC have lifted the last four Serie A trophies, the club still trail AC Milan in commercial and sponsorship income terms with EUR 85 million. It is also interesting to note that, in the current season (2015/16), six Italian clubs do not have a shirt sponsor, and of these, three clubs are playing in UEFA competitions (AS Roma, SS Lazio and ACF Fiorentina). This is perhaps an indication of how Serie A has been losing both its global and local appeal in recent years, with international sponsors appearing to lose their appetite for Italian clubs.

Outside the ‘big five’ leagues, the Russian Premier League stands out as the most lucrative in terms of commercial and sponsorship income with EUR 537 million in 2013/14, higher than both Spain and Italy.

While the ‘big five’ leagues account for 67% of Europe-wide commercial revenue, Russia and the Netherlands are the only other two leagues to generate more than EUR 100 million with the remaining 47 European leagues registering a combined commercial income of approximately EUR 1 billion.

Unsurprisingly, this analysis re-confirms how major football sponsorship interest is focused on clubs with home and international sporting success and exposure, and which are therefore capable of attracting wide fan bases. In the future, clubs playing outside of the ‘big five’ leagues - especially clubs playing in countries with relatively small populations and economies - will face stiffer challenges than in the past when trying to attract commercial revenue from both domestic and international corporations. With the exception of Russia and Turkey, countries with larger than average economies and populations, it is difficult to foresee second tier leagues being able to break into the upper echelons of commercial income generation.