The coronavirus pandemic not only disrupted everyone's daily life, but also that of the entire football eco-system, resulting in an unprecedented complexity of issues and dilemmas for the global sport. In those months, KPMG’s Football Benchmark team identified the key challenges faced by the industry. In mid-March, we summed up how the coronavirus pandemic would impact the game, and provided estimates on losses the top 5 leagues were likely to face assuming a worst-case scenario with no more games played in the current season. In early May, we illustrated how COVID-19 has hit football players' market value, and provided player value estimates for two potential scenarios – a cancellation of the ongoing season and a completion of the season with games played behind closed doors. In our latest report, besides ranking Europe’s 32 most prominent football clubs according to their enterprise value (EV) as at 1 January 2020 – based on pre-COVID data – we also examined the longer-term implications of the pandemic, with some key industry personalities sharing their views on the most topical aspects threatening “the beautiful game”.

It is unquestionable that club values have been affected by the pandemic, too, but the immediate and specific impact at club level cannot yet be quantified as the financial statements for the current football season will only be published in the months to come. With clubs unable to host and play games, all of their income streams have been affected by the absence of gate receipts and renegotiation, suspension or cancellation of broadcasting and commercial payments by media partners and sponsors. On the other hand, operating costs (i.e. mainly player wages) have not decreased at the same rate, leading to a negative impact on both financial profitability and the clubs’ liquidity position.

Hereby, we aim to synthesize these insights and analyze how the pandemic impacted the EV of these top football clubs as a whole and thus provide an indication of the devaluation of the most elite clubs in the industry, amid the coronavirus crisis.

COVID-19 impact on squad value

The coronavirus disruption is certainly having an impact on players' market value. Football clubs are facing an unprecedented crisis, which is making a dent in their financial performance; without live football, they are facing missed earnings, some of them already having liquidity problems.

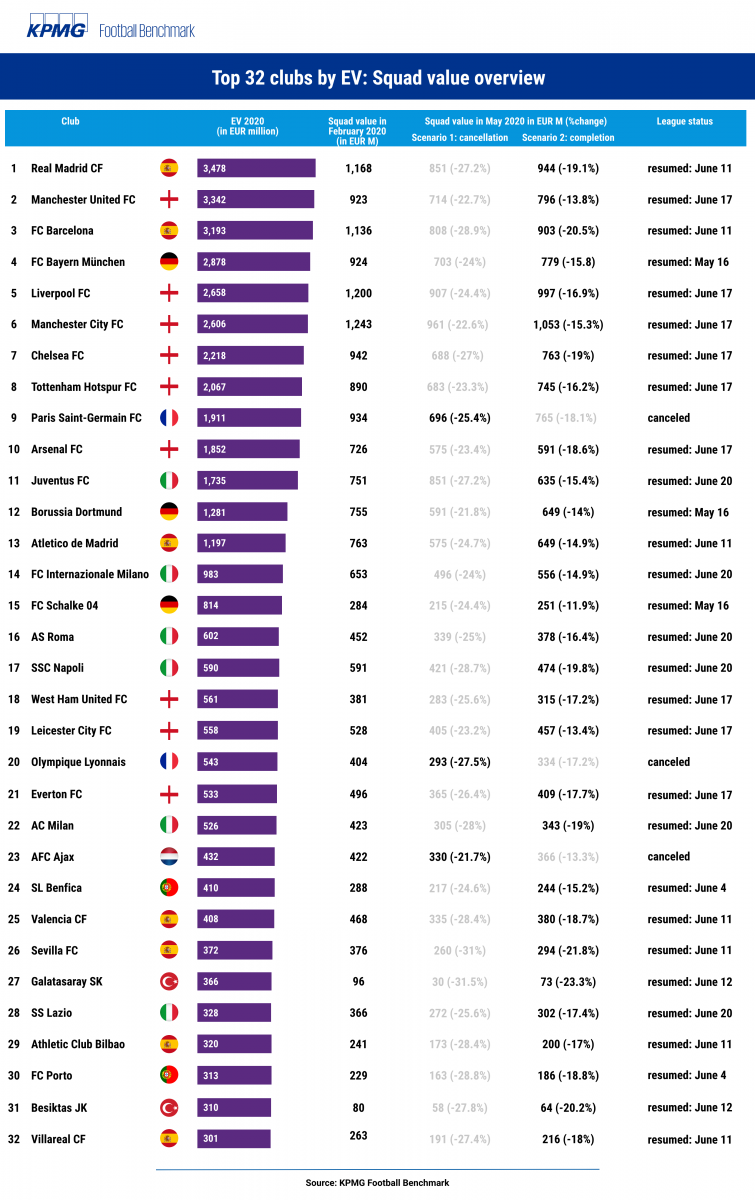

In a recent KPMG analysis of the impact of COVID-19 crisis on football players' market value, we have examined what factors impact player values with football on hold, and provide value estimates for two potential scenarios – a cancellation of the ongoing season (a scenario that fortunately does not appear to be applicable in most European countries), or a completion of the season in the following weeks with all matches played behind closed doors. Our analysis revealed that the aggregate value of all 4,183 players in the 10 European leagues under consideration decreased by a total of almost EUR 10 billion, a 26.5% drop since February for Scenario 1 (cancellation), whilst players’ values would decrease by EUR 6.6 billion, a 17.7% decrease in Scenario 2 (continuation and completion of the current season). It is also important to observe that the most valuable players, generally engaged by teams in the top-10, top-15 clubs by EV ranking, are more resilient and better retain their value.

In addition, we have now taken into consideration how squad values of the 32 most valuable European football clubs (based on their EV) have changed in the wake of the pandemic. Our chart shows how squad values of the 32 clubs changed according to the two scenarios in comparison to February’s values. KPMG has not modeled a hybrid scenario, in which some leagues will be continued and others halted - in one scenario we assumed that all leagues are canceled, while in the other the assumption was that eventually all leagues continue behind closed doors. That said, we can ascertain that canceled leagues will probably see a larger decrease in value.

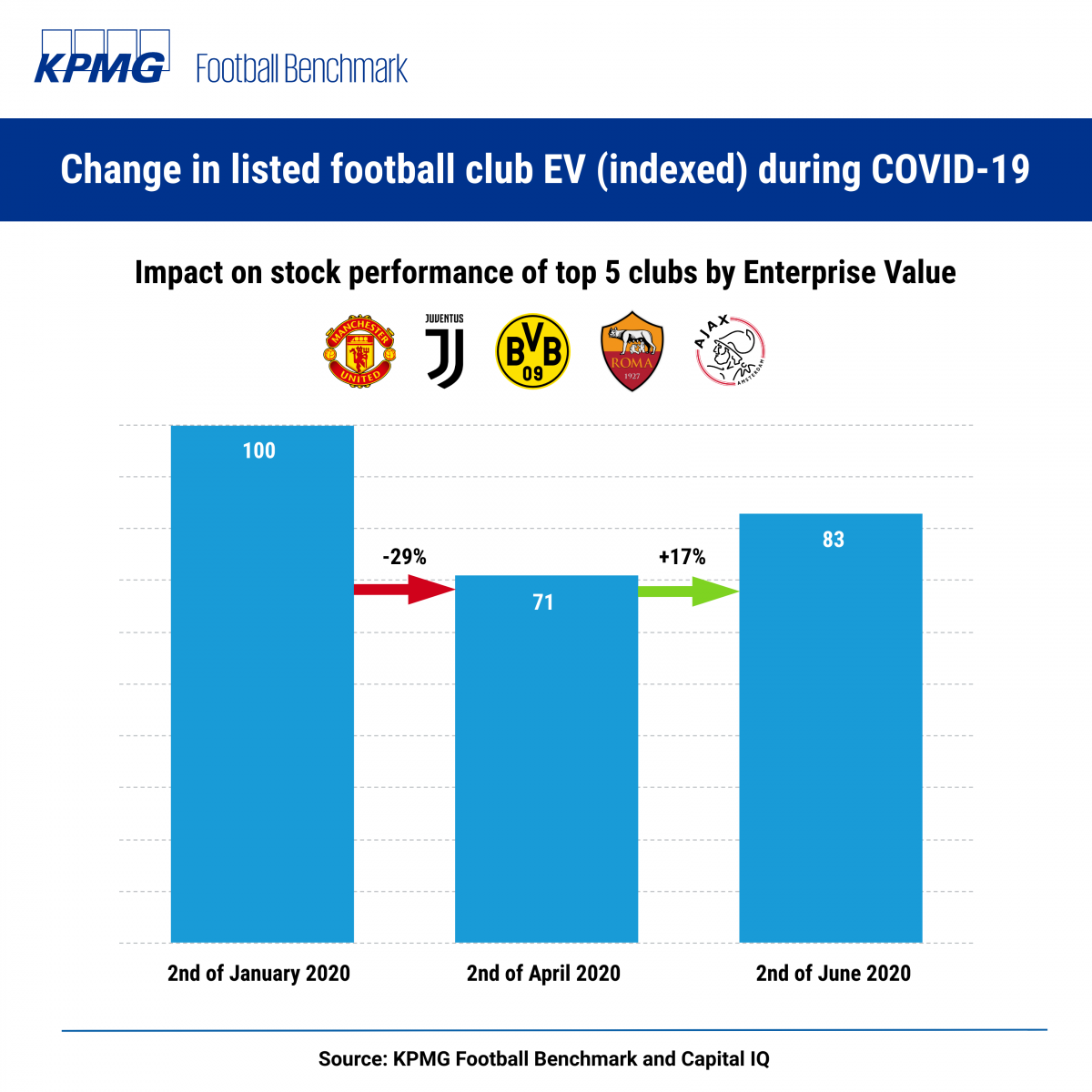

COVID-19 impact on publicly-listed football clubs

While there has been a significant drop in football clubs' share prices listed on various stock exchanges since the outbreak of the crisis, a recovery has been seen in the past several weeks, with the prospect of a restart of the 2019/2020 football season in most countries. We have observed a -29% drop in EV on markets (market cap plus net debt) for a selection of football clubs listed on various stock exchanges since the outbreak of the crisis (i.e. the first 3 months of 2020). However, there was an EV recovery in late May following the increased clarity from expressions of intent to complete the season, albeit behind closed doors.

The following chart shows the change in the top 5 listed football clubs’ enterprise value (indexed) during COVID-19.

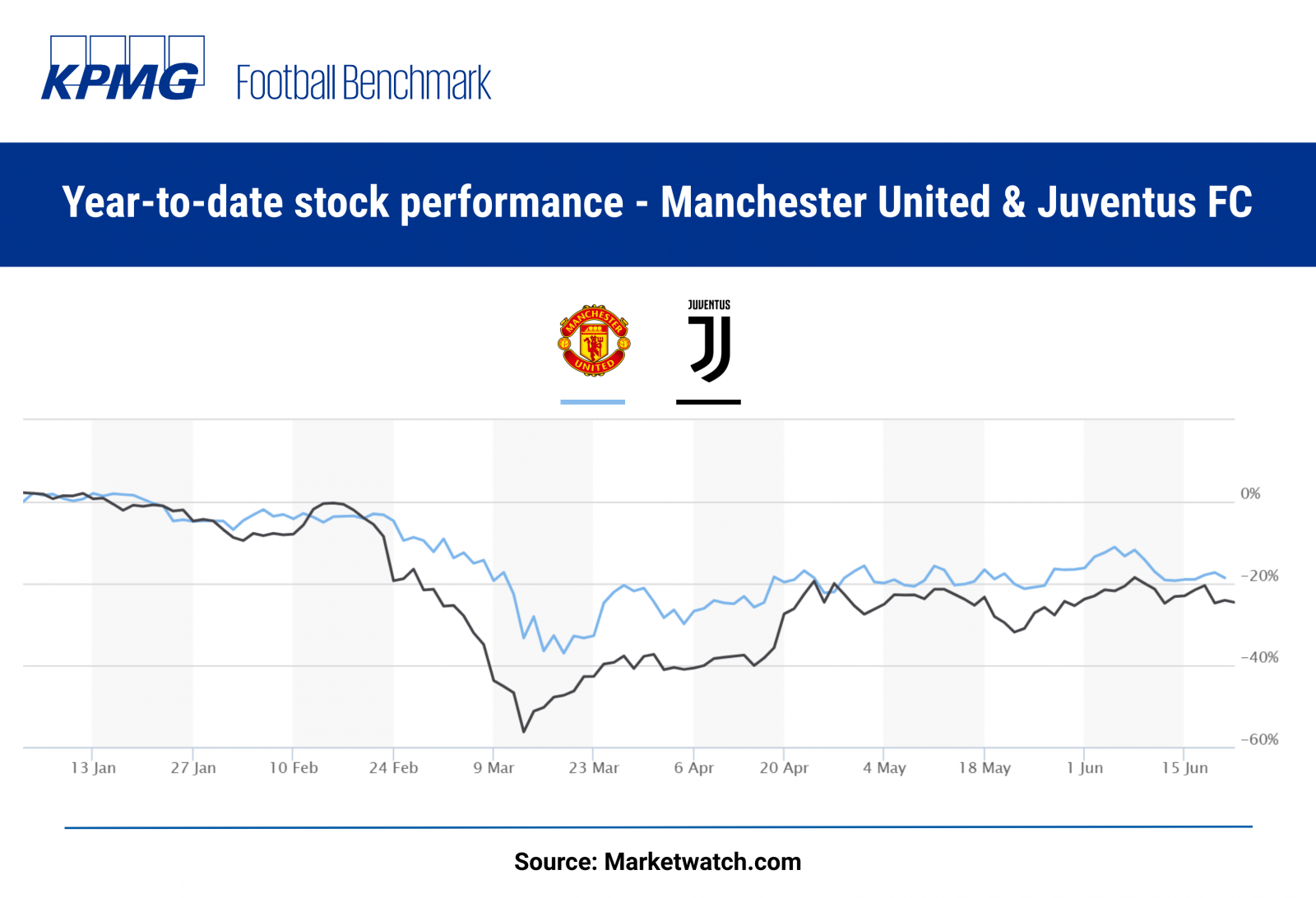

When looking at the two stocks with the highest volume of trading – Manchester United and Juventus – the YTD price evolution of their shares provides additional background to draw our preliminary conclusion on the overall devaluation of the football industry at the elite level between early January and late May when the restarting of the football season in most European countries was confirmed.

Conclusion: COVID-19 impact on elite clubs’ enterprise value

All in all, the expected drop in revenue, profitability and player values (from the 2019/20 season onwards) will negatively affect football clubs’ valuation.

“Taking into account players’ devaluation and the performance of the largest listed clubs in recent months, KPMG’s forecast of the devaluation of the football sector at the top end of the market is between 20% and 25%, when compared with our recently published results of clubs’ EV as of 1 January 2020. Having said that, I believe peak devaluations for individual clubs can range from 15% up to 30%. This depends on the strength of a particular club’s balance sheet, level of debt, structure of revenue mix and dependence on player trading activities. Obviously, each club’s situation and EV impact will need to be assessed individually upon availability of their 2019/2020 financial statements,” Andrea Sartori, KPMG’ Global Head of Sports concluded.