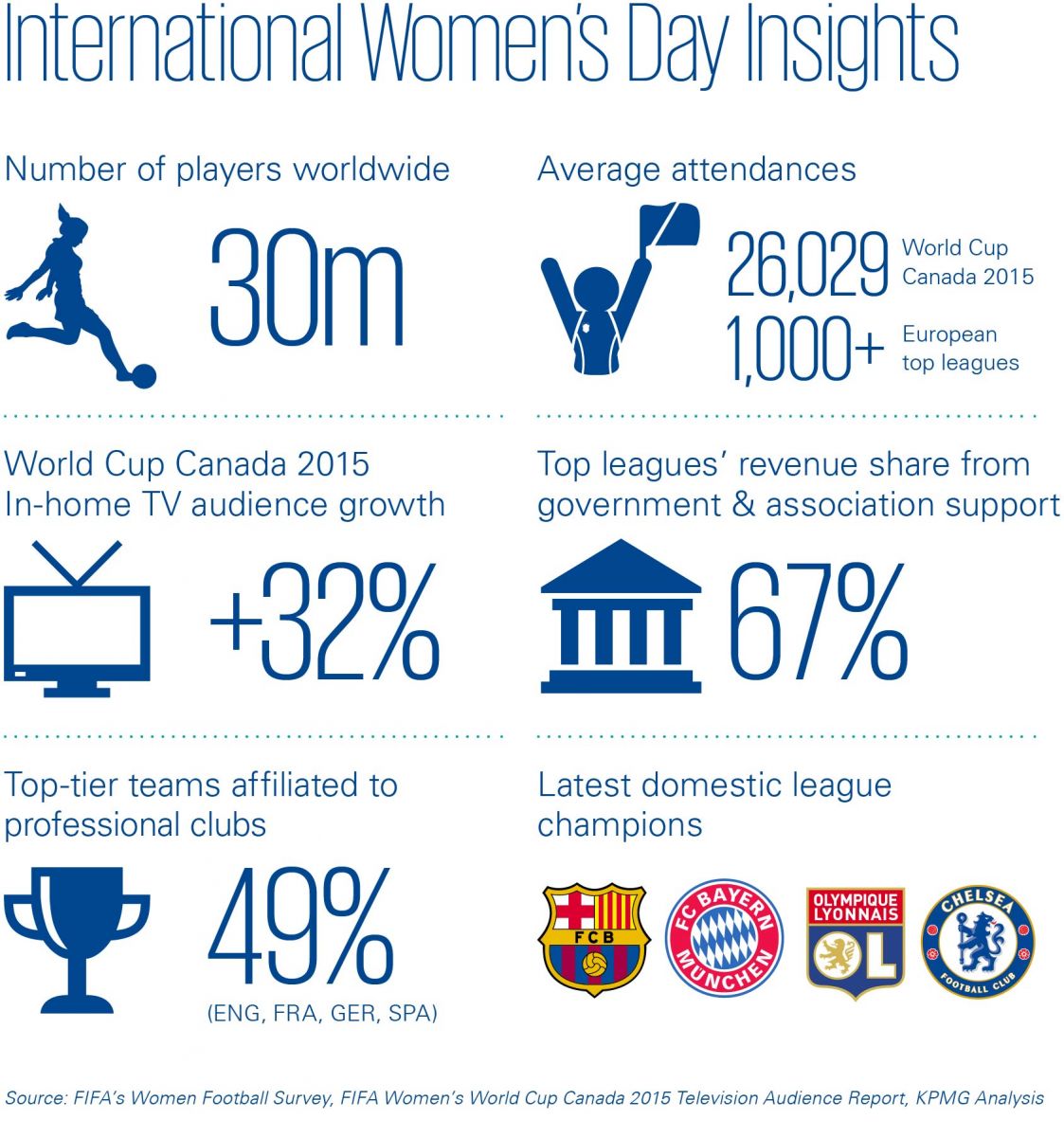

Exciting times are ahead for women’s football and the fact that the Women’s World Cup Final last year in Canada between the USA and Japan was the most watched football match in US history (over 25m viewers) is just a sign of this. The tournament marked another major milestone for an ever-evolving sport and, whilst approximately 67% of viewers were still male, it managed to reach an in-home audience (i.e. those watching 20+ consecutive minutes) 32% higher than its previous edition in 2011. The relevance of this figure for the industry can be better understood when compared with the same indicator for the last men’s World Cup, which saw no growth in audiences.

From the perspective of the world’s football governing body, supporting the growth of the women’s game will be a key area of focus during the mandate of the new FIFA president Gianni Infantino. As a first step, a set of reforms were approved during the recent Extraordinary Congress of the organization, ensuring not only further recognition and the promotion of women’s football but also a higher number of women in decision-making positions across confederations.

Looking at the future, the consensus among all confederations is that the number of players is a key priority in the development of the sport. Whilst the number of male players has been estimated at more than 250 million worldwide, the number of women playing the beautiful game is now approximately 30 million.

Besides increasing the number of players at grassroots level, raising the profile of national competitions to a level comparable to men’s leagues is another major challenge for the game. A key factor here is to increase interest in women’s football at traditional clubs. Over the last six seasons, the number of women’s teams fielded by a professional club with an equivalent top-tier men’s squad has risen from 35% to 49% in the analysed markets (Germany, England, Spain and France). Moreover, the fact that FC Barcelona, FC Bayern München, Olympique Lyonnais and Chelsea won their corresponding domestic titles last season highlights the role of major clubs on the road towards the professionalization of women’s football. Despite this trend, in Italy’s Women’s Serie A there is still only one professionally affiliated club (ACF Fiorentina), and across Europe, several not professionally affiliated clubs have repeatedly declared difficulties in even covering their operational costs.

According to FIFA’s latest survey on women’s football, association support (55%) and government funding (12%) still represent a very significant percentage of national league clubs’ revenue across top associations. In line with the traditional revenue distribution at football clubs, increasing the level of media coverage, attendances and sponsorship deals have been repeatedly pointed out as the way towards financial sustainability. However, the often-heard statement that all these areas are strongly dependent on each other has created a vicious cycle that gives no clear answer to the key question - Which of them will lead the way in the development of the sport in the coming years?

Despite impressive attendance figures at major events such as the latest Women’s World Cup (26,029 on average) or the Women’s FA Cup final in England (30,710), average attendances across top national women’s leagues are still very low (1,000+ on average). Due to the difficulty of competing for spectators who may prefer longer-established sports, an affordable and more inclusive matchday experience in line with the requirements of a wider audience may lead to higher attendances and revenues.

With regards to broadcasting, at the current stage of development, media attention is more a means of gaining exposure and sponsorship deals. Thus, sponsorship, which currently accounts for 24% of the revenues across top association’s leagues, is more likely to drive the income growth in women’s football. Whilst recently successful sponsorship and naming-rights deals have been agreed by the German Women’s Bundesliga (Allianz) and the Women’s FA Cup (SSE), several valuable assets remain unexploited, offering potential sponsors an affordable brand association with the world’s game and a strong association with equality. The women’s league in Spain, which has recently strengthened its brand after being included under the umbrella of La Liga, might be the next to follow.

Although major women’s football events have demonstrated their ability to attract large crowds, further improvements in the issues mentioned above are still required to achieve full professionalization and year-round sustainability of the sport. Commercial and matchday income seem to be the key income sources in the short term and the ability of rights holders to exploit them will determine the future of the game in the coming years.

Covering all aspects of modern football as a business, the Football Benchmark Team at KPMG’s Sports Practice can undertake further analysis of football industry data for you. Experts here can also assist stakeholders to assess and interpret the potential impact on their own organisations as suggested through analysis of key footballing issues and to identify firstly specific trends and then solutions to any related questions.