When Manchester United last won the Premier League in May 2013, the club’s Twitter page was being followed by just over 1 million people. In September 2016, this number stood at 9.9 million while the club’s pages on Facebook and Instagram were attracting 71m and 13.5m followers respectively at the same time. In recent years the explosion of social media has changed the way many fans engage with sports, extending the fan experience beyond the actual matchday and, significantly, creating new business opportunities for football clubs.

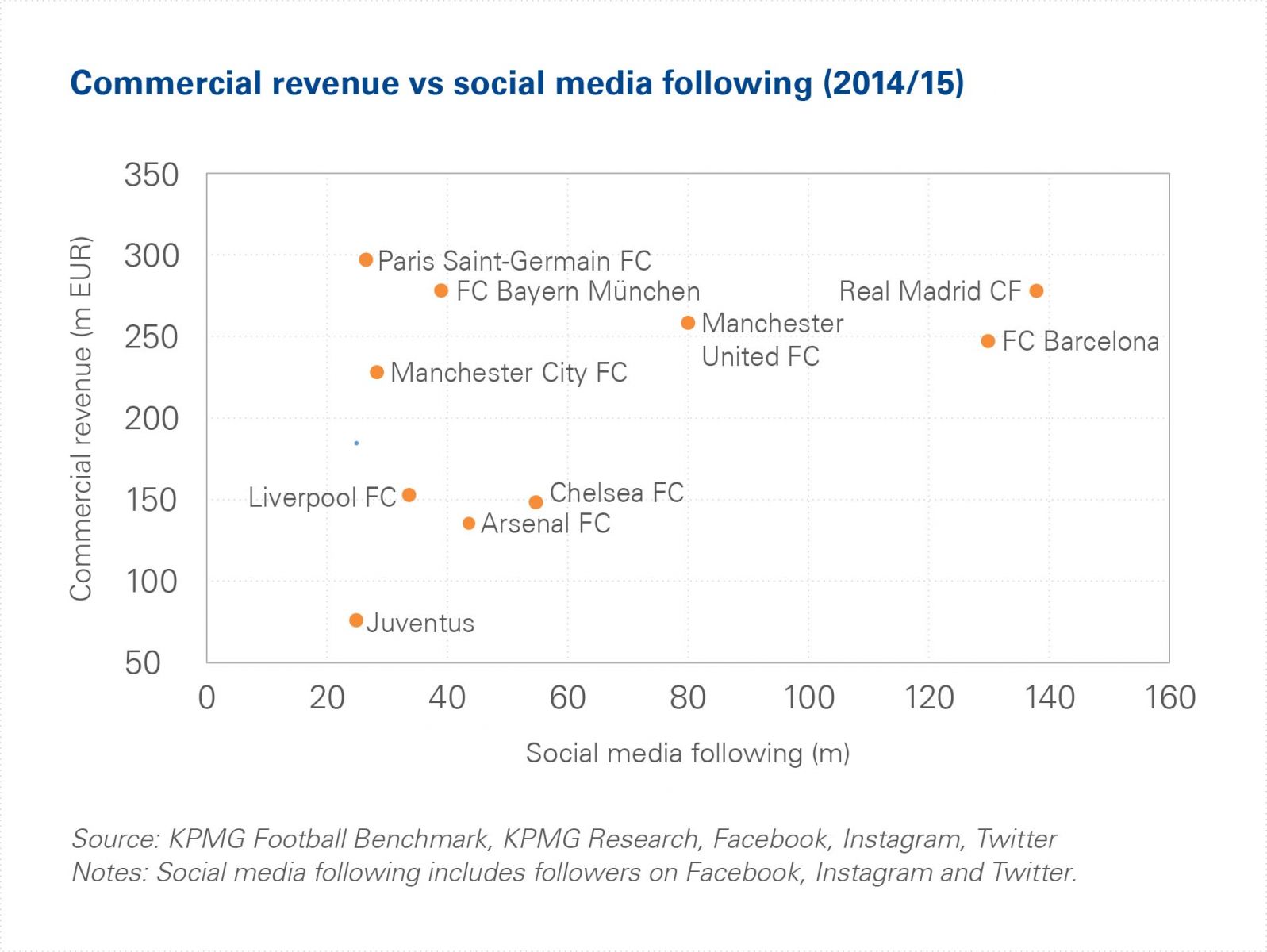

Whilst major leagues’ broadcasting deals are negotiated collectively and matchday revenues are still strongly linked both to a team's short-term sporting performance and the state of their stadia, nowadays commercial revenues are strongly impacted by a club’s global reach. In this article, KPMG’s Football Benchmark team analyses the correlation between the most popular clubs’ social media followers (Facebook, Instagram and Twitter) and their commercial revenues.

Since September 2014, the combined social media followers of the Top 10 most popular clubs across Facebook, Instagram and Twitter has jumped by 70%, demonstrating the important role of social media platforms connecting sports entities with their global audiences. A key contributor to this growth has been Instagram, where the combined level of attention on these clubs increased from less than 16m in September 2014 to 132m last month. This massive rise has certainly caught the eye of football clubs who are taking ever greater steps to reach fans in all geographies, as demonstrated by the facts that Manchester City operate Twitter accounts in more than ten different languages and Real Madrid’s Arabic Twitter page alone is followed by 5.7m people.

The most followed clubs, Spanish giants Barcelona and Real Madrid, have also registered the highest growth in absolute terms over the last two seasons, with both clubs increasing their total follower base by more than 65m each. Meanwhile, Paris Saint-Germain FC (134%), FC Bayern München (108%) and Juventus FC (108%), bolstered by domestic titles and participation in the latter stages of the UEFA Champions League, have recorded the highest percentage increases. However, social media is clearly a common factor for major interest-generating clubs, all of which have seen a minimum increase of 44% in such followers since 2014.

Importantly, this industry trend has often been accompanied by an increase in commercial revenues. In fact, despite slightly different sporting outcomes, FC Bayern München, Juventus FC and Paris Saint-Germain are the only clubs under review that reported a drop in commercial revenues between the 2013/14 and 2014/15 season. A purely successful example at individual club level is FC Barcelona, which, in the 2014/15 season, replicated its on-pitch success (Champions League title) off the pitch, recording a 34% increase in commercial revenues (EUR 207m to EUR 278m) and 31% growth in social media followers (105m to 138m).

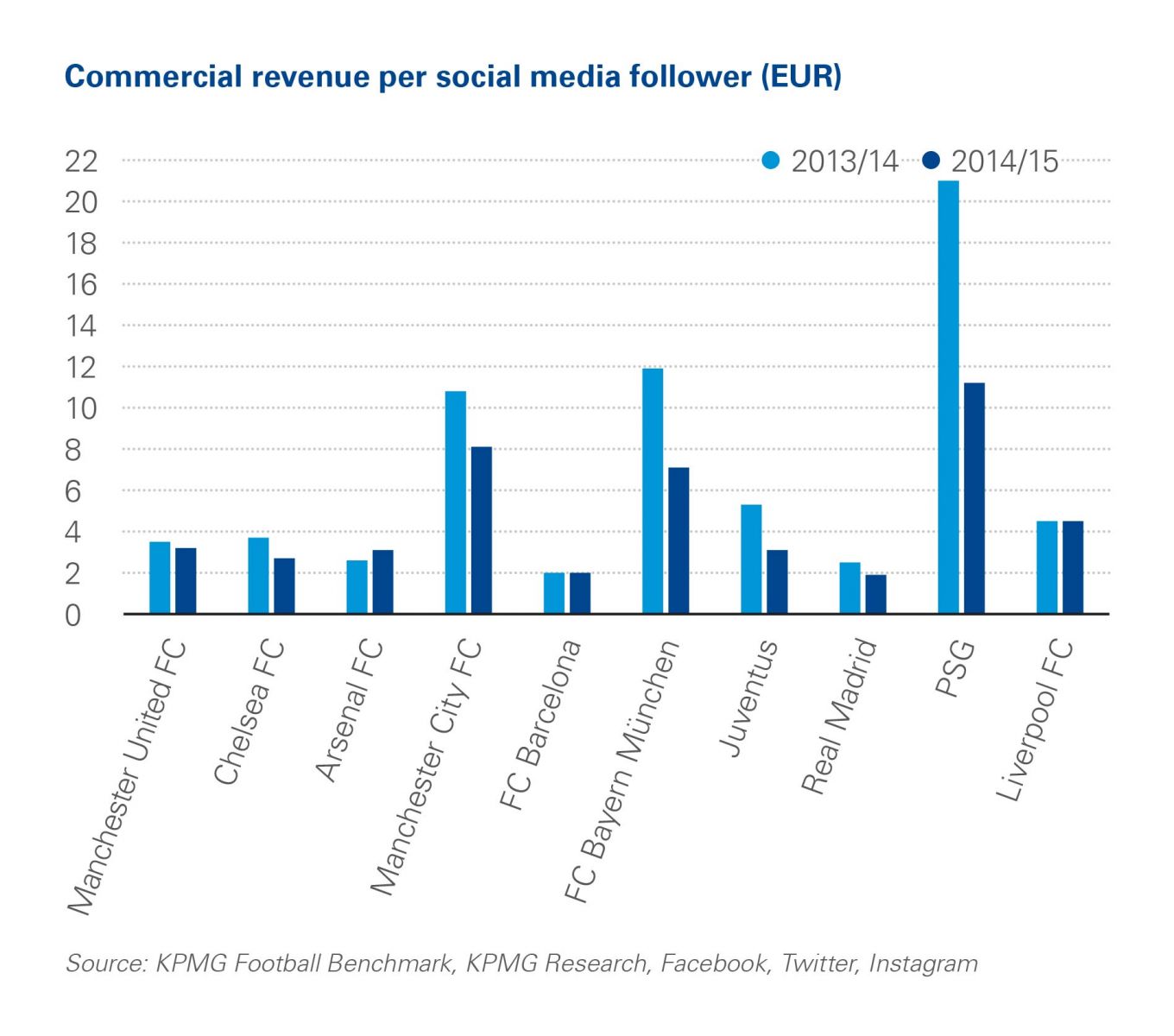

Whilst major clubs undoubtedly profit from gaining global followers by generating higher commercial revenues than domestic rivals with more of a local fan base, the income differences between the most followed teams requires further investigation. An analysis of commercial income per follower demonstrates that, in addition to the follower base of a club in digital space, this revenue source might also be impacted by other factors. In fact, with the exception of FC Barcelona, Liverpool FC and Arsenal FC, and despite the general increase in commercial revenue, the clubs’ per follower value saw a net decrease from 2013/14 to 2014/15, suggesting that higher commercial gains do not automatically follow social media base gains.

Additional factors may include, amongst others, the duration of commercial agreements, the capability to negotiate advantageous sponsorship deals, the location of the club, the demographics of their followers or even follower duplication across different platforms. For example, across the analysed sample, Manchester City’s, Paris Saint-Germain’s and FC Bayern München’s commercial revenues per follower stand out above the rest, as these clubs’ commercial operations are supported either by favourable sponsorship deals (MCFC, PSG) or the commercial strength of their domestic market (FCBM).

Moreover, it is especially interesting to note how clubs lower in the ranking, both in terms of followers and commercial revenues, such as Juventus FC and Liverpool FC, recorded a considerably higher commercial revenue per follower than those at the top, in particular FC Barcelona and Real Madrid. However, rather than stressing differences between the business operations of these clubs, this contrast seems to highlight that the monetization of social media followers by a football club has a long way to develop yet.

Whilst further analysis should consider the clubs’ following in other platforms, such as country-specific social media, this conclusion highlights once again the difference between the economic strength of football clubs and the level of fan engagement that they are able to generate. As clubs focus their efforts on driving fans from social media to their own platforms, those able to harness the potential of their global brand in the digital space are likely to develop a competitive advantage in the coming seasons. However, the question remains - can these football clubs succeed in monetizing this ever expanding social media following and achieving a higher per follower value?