Manchester City FC Limited, controlled by City Football Group Limited and ultimately owned by the Abu Dhabi United Group since 2008, achieved an historical landmark in the 2014/2015 season, reporting a profit for the first time since their acquisition by the Emirati owners. Last season ended without a title, as the Citizens finished as runners-up in the Premier League, and were eliminated in the last 16 of both the UEFA Champions League and the Football League Cup, and in the fourth round of the FA Cup. Despite this, revenues increased for the seventh consecutive year to reach a record-breaking GBP 351.8 million (EUR 491.7 million)[1] at the end of the 2014-15 season. In addition, wage costs have now been reduced for the second consecutive year and their relationship to revenues stands at a healthy 55% (down from 114% in the football season 2010/2011). To top this, the club operate at zero financial debt and the owners run the business mostly through equity, which represents 77% of total assets.

On the pitch, the club have become part of the European elite, thanks to their two English Premier League titles in the last 5 years, one FA Cup and one Football League Cup titles won, and as regular participants in the UEFA Champions League and contender of the major national titles.

In this article, the KPMG Football Benchmark team analyses the financial performance of Manchester City FC over the last five seasons. The club’s sporting success has been backed by a revenue increase of 130% since 2010/2011.

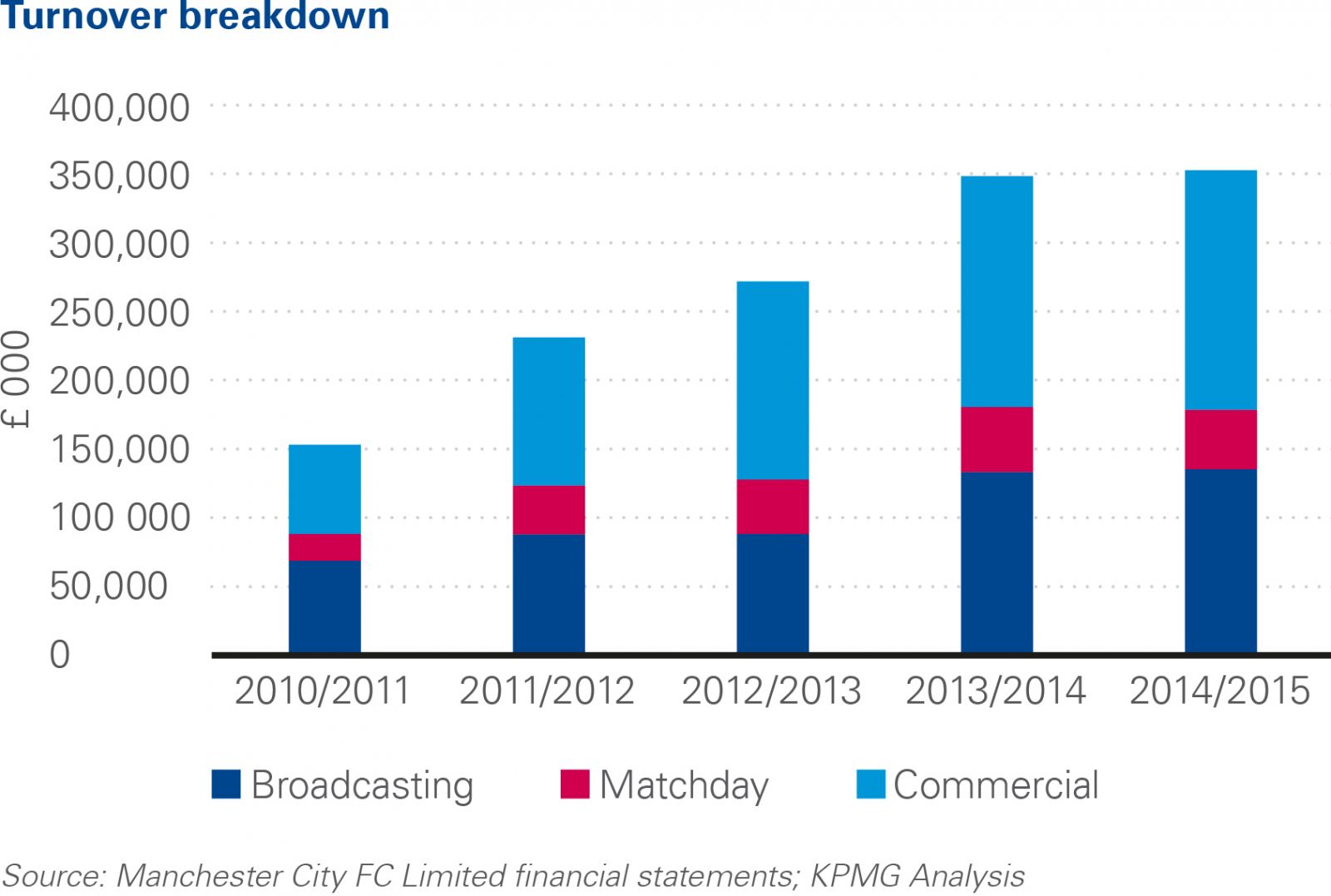

The 2014/2015 season saw revenue growth of approximately GBP 4 million, mainly driven by commercial and broadcasting income. The club experienced a commercial growth of approximately GBP 6 million last season thanks to 22 new partnerships; commercial revenue has been the main component of Manchester City FC’s off the pitch success, the figures having improved by 169% since 2010/2011. Much credit for this must be given to the ten-year, GBP 400 million deal with main sponsors Etihad Airways, signed back in 2011. The 2014/2015 season was the first one in which all of City Football Group’s sister clubs – Major League Soccer franchise New York City FC, Australia’s A-League Melbourne City FC and Japanese J-League Yokohama F. Marinos - were operational and competing at the same time. This innovative, cross-continental strategy has benefited Manchester City FC commercial revenue growth and has opened up unique opportunities for City Football Group partners. In fact, new deals signed between City Football Group and sponsors in search of global exposure provide such a sponsor with broad market visibility in four different leagues and beyond, a competitive advantage very uncommon in football industry.

In comparison to the previous season, broadcasting revenue showed a slight increase of approximately 2%. The new reported domestic TV deal starting from 2016, worth GBP 5.136 billion over three years, will play a decisive role from next season towards boosting income. Growth in these two income streams more than offset the current 9% decrease in matchday revenues, which has mainly been due to reduced capacity because of stadium expansion works.

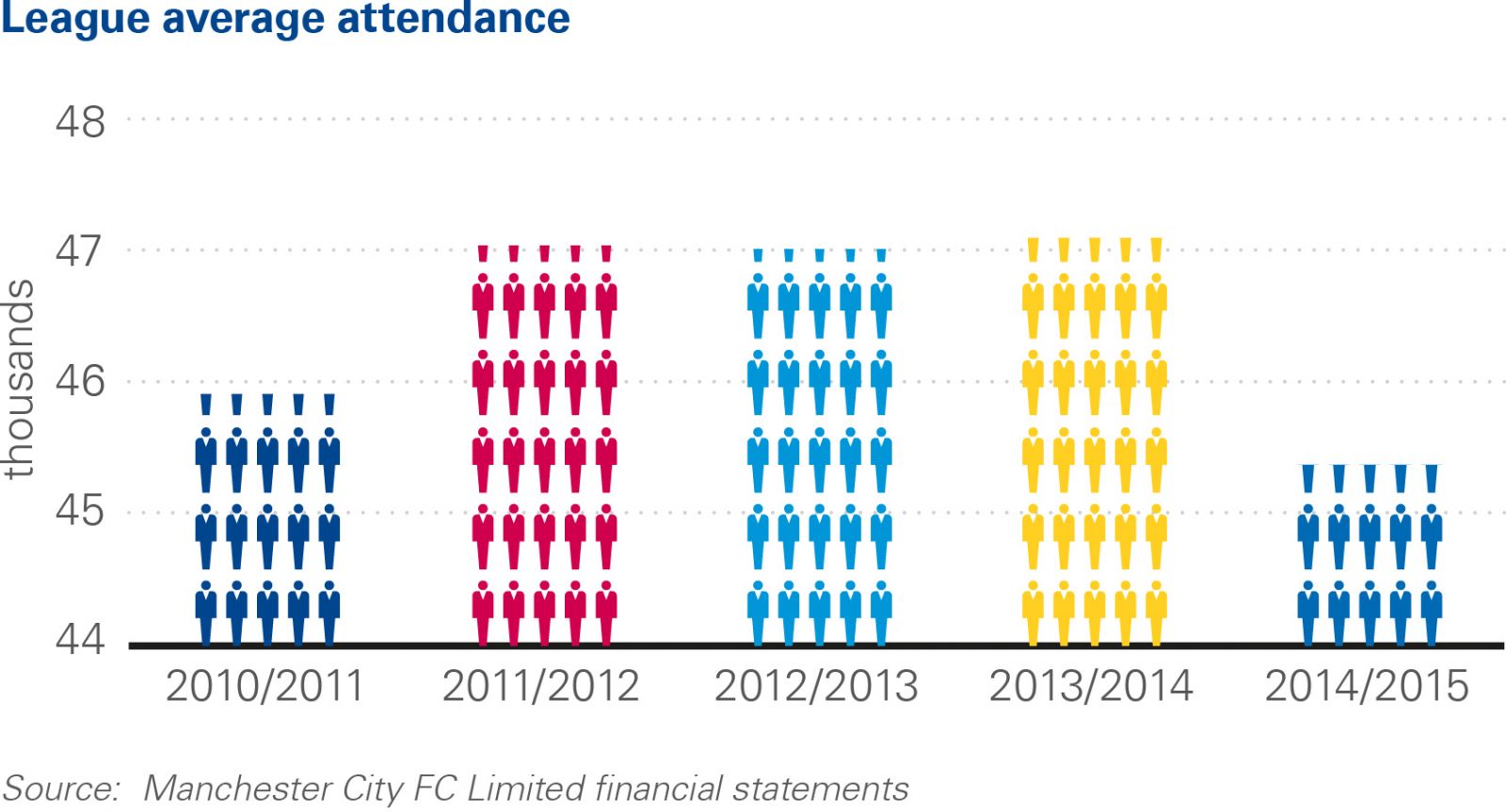

Although ticketing represented only 12% of total revenue in 2014/2015, the club have achieved a 99% stadium occupancy rate in all but the first campaign under analysis; the same has happened with season tickets, sold out for the fourth year in a row. An enlarged capacity from 47,405 to 55,000 will help in leveraging matchday performances and further increase revenues. In 2003 Manchester City FC’s former stadium, Maine Road, was exchanged for a 250 year leasehold interest in the Etihad Stadium site, with the lease being treated as a financial lease and valued in accountancy terms at GBP 144.5 million at the end of last season. In December 2014, the club then inaugurated their state-of-the-art City Football Academy, with 16 football pitches, a medical centre, sports science and education facilities, on-site accommodation and the 7,000-capacity Academy Stadium. This is a significant milestone towards the better recruitment, training and development of youngsters and a demonstration of the change in management philosophy at Manchester City FC. The club clearly have one eye on sustainability, aiming to prepare home-grown talent for the first team squad.

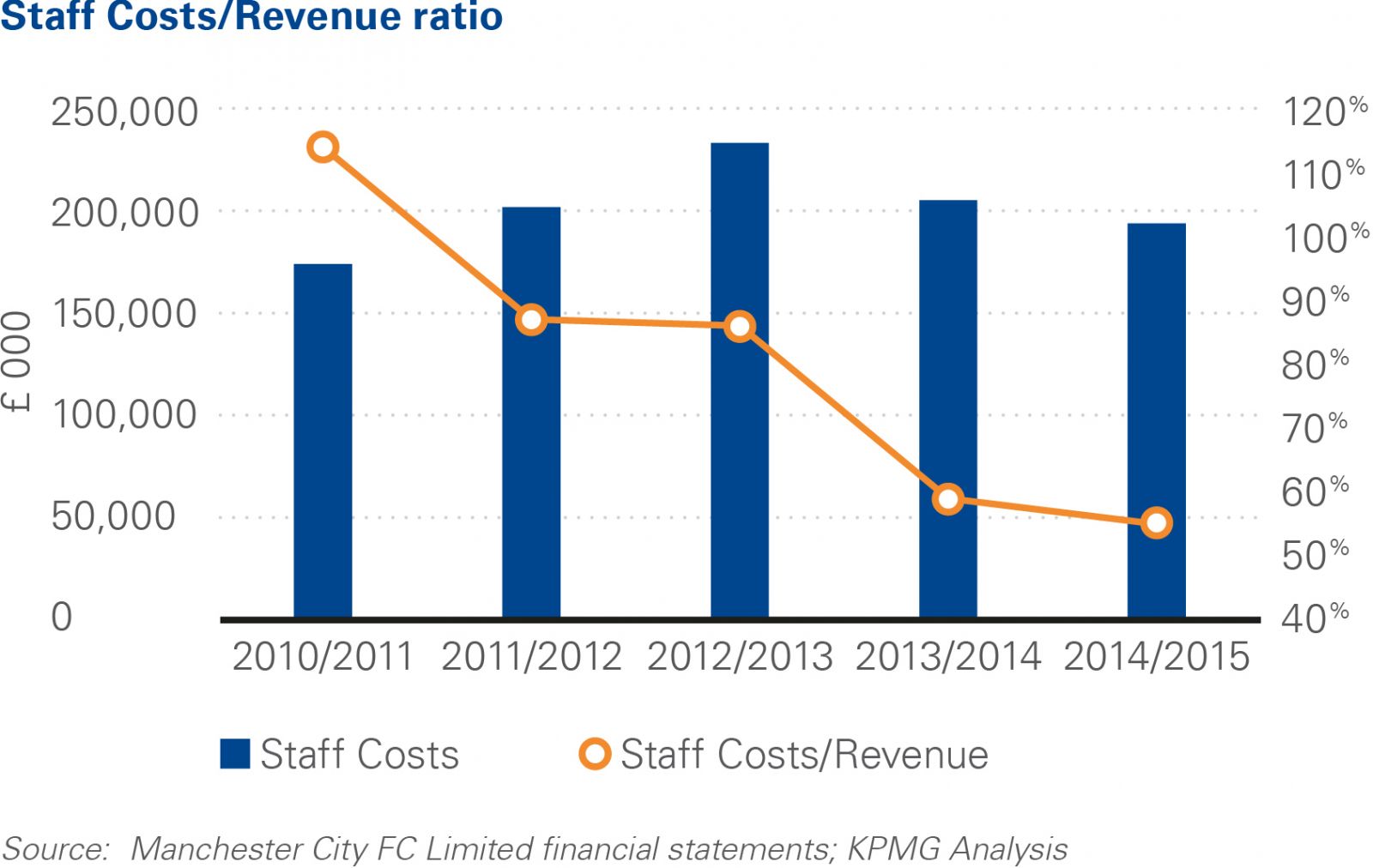

As turnover has grown, so have expenses. As it is usual for football clubs, the highest cost items are wages and salaries, accounting for 69% of total costs in 2014/2015. In 2012/2013, the club had the highest wage bill in the entire Premier League, an annual GBP 233 million (EUR 325.6 million), covering 449 full-time staff. However, although wages rose by 11% from 2010/2011 to 2014/2015, these have been outpaced in the same period by the 130% revenue growth we mentioned earlier. Indeed, the club managed to reduce the wages/turnover ratio from 114% in 2010/2011 to 55% by the end of last season. This indicator is one of the parameters monitored by UEFA in accordance with their Club Licensing and Financial Fair Play Regulations; these figures should not exceed the 70% threshold. In parallel, the number of full-time staff was also cut to 320.

In this context, the recent reduced losses arising from player trading also display the efforts the club is making towards greater business sustainability. Indeed, the impact of player trading on total revenues has decreased year-on-year.

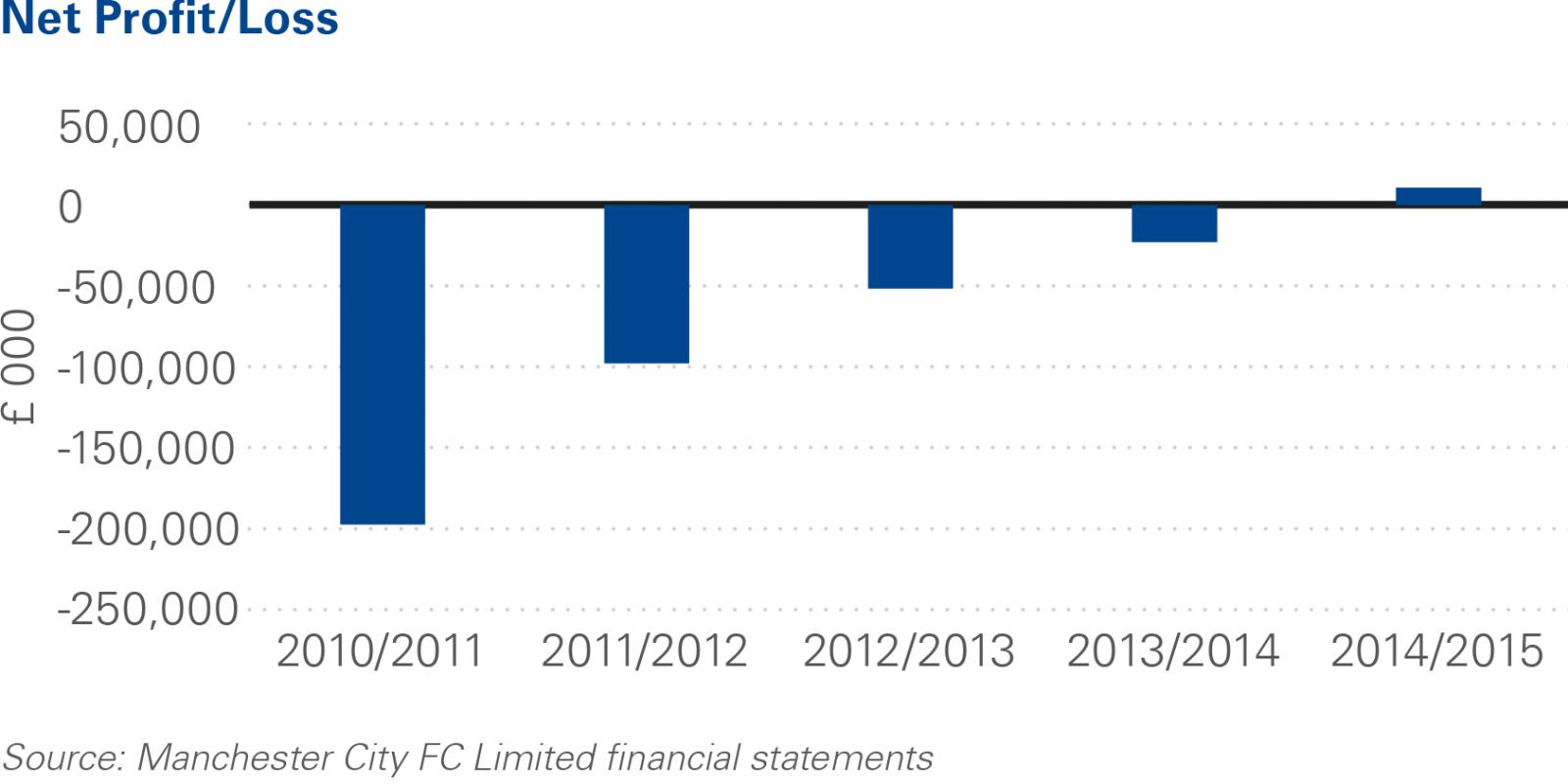

Net profit/loss continues to rise. Losses have been halved for three consecutive seasons, reaching the first bottom line profit of GBP 10.7 million at the end of last season, after the club saw almost GBP 370 million cumulative losses between 2010/2011 and 2013/2014.

Unlike most of their domestic and international peers, the club run the business with zero financial debt. The capital increases made by Sheikh Mansour bin Zayed over the years has positively influenced the financing structure of the club, with equity now standing at 77% of total assets.

The UEFA regulatory environment certainly played a role in Manchester City FC’s path towards financial sustainability; after they were sanctioned for breaching the rules and facing the risk of being excluded from participation in the UEFA Champions League, the club’s efforts to comply with Financial Fair Play regulations were creditable.

Manchester City FC and the settlement agreement with UEFA

Manchester City FC did not escape the bite of Financial Fair Play Regulations. In fact, the club did not manage to comply with the break-even requirement, unable to meet the EUR 45 million aggregated losses threshold allowed for the first monitoring period, covering the two campaigns up to the end of 2012/2013. In the settlement agreed upon with UEFA in May 2014, the club committed to report a maximum deficit of EUR 20 million by the end of the 2013/2014 season and EUR 10 million by the end of the 2014/2015. Furthermore, the club was forced to register only 21 players for UEFA competitions in 2014/2015, not to increase wages for the 2015 and 2016 reporting periods and had to pay a EUR 20 million fine. In view of the recent reduction of losses, the club complied with the break-even targets and UEFA lifted the imposed restrictions in July 2015.

The strategy of Manchester City FC is based on maximizing sources of income rather than on major cost cutting, in order to be able to offset stable yearly cost increases, these being almost inescapable for any club willing to establish itself in the European football elite. It is also true that the domestic environment, with the Premier League securing the highest TV deals in Europe, has positively affected the financial performance of Manchester City FC. However, the club have been able to make important steps towards sustainability based on their own strategies too, such as improved branding and commercial exposure, stadium expansion and the construction of the new Academy.

The recognised on-and-off pitch success and the global exposure of the Manchester City brand surely encouraged the recent acquisition of a minority stake of 13%, for a reported GBP 265 million, by a Chinese media, entertainment and sports consortium (China Media Capital). This investor has a strong presence in Chinese football, being the owner of exclusive media rights to both the Chinese Super League and the China Football Association. The deal has the declared purpose of leveraging the potential for the growth of all the clubs of the Group in light of massive growth and interest in football in China. In the context of becoming even more successful on the pitch and recognised as an international brand, Manchester City FC have also just announced that world-class manager Pep Guardiola will be in charge from the beginning of next season. The future of Manchester City FC looks promising.

The Football Benchmark Team of KPMG Sports Practice can undertake further analysis of football industry data for you. The subject matter experts within the group can also assist stakeholders to assess and interpret the potential impact on their organisations suggested by the results of particular pieces of research and to identify reasons why a specific trend is being observed or to assess potential solutions and future scenarios.

[1] With an exchange rate of GBP = EUR 1.3976.