Tonight, two giants face off in the semi-finals of the UEFA Champions League, when Manchester City FC step onto the pitch against Paris Saint-Germain FC. It's the second time these two teams will have met in the competition, following a tightly fought battle in the 2016 quarterfinals in which Manchester City emerged victorious. In the current iteration, Manchester City have yet to lose a game, only registering a single draw in the group stages. Meanwhile, PSG have lost three games already, although they were arguably handed tougher group and knockout bracket matchups that included last year's champions FC Bayern Munich and FC Barcelona. Both clubs aim to capture their first Champions League trophy, which would serve as a symbol of validation for the mammoth sporting projects both sides have undertaken since the current ownerships' arrival.

Recent history

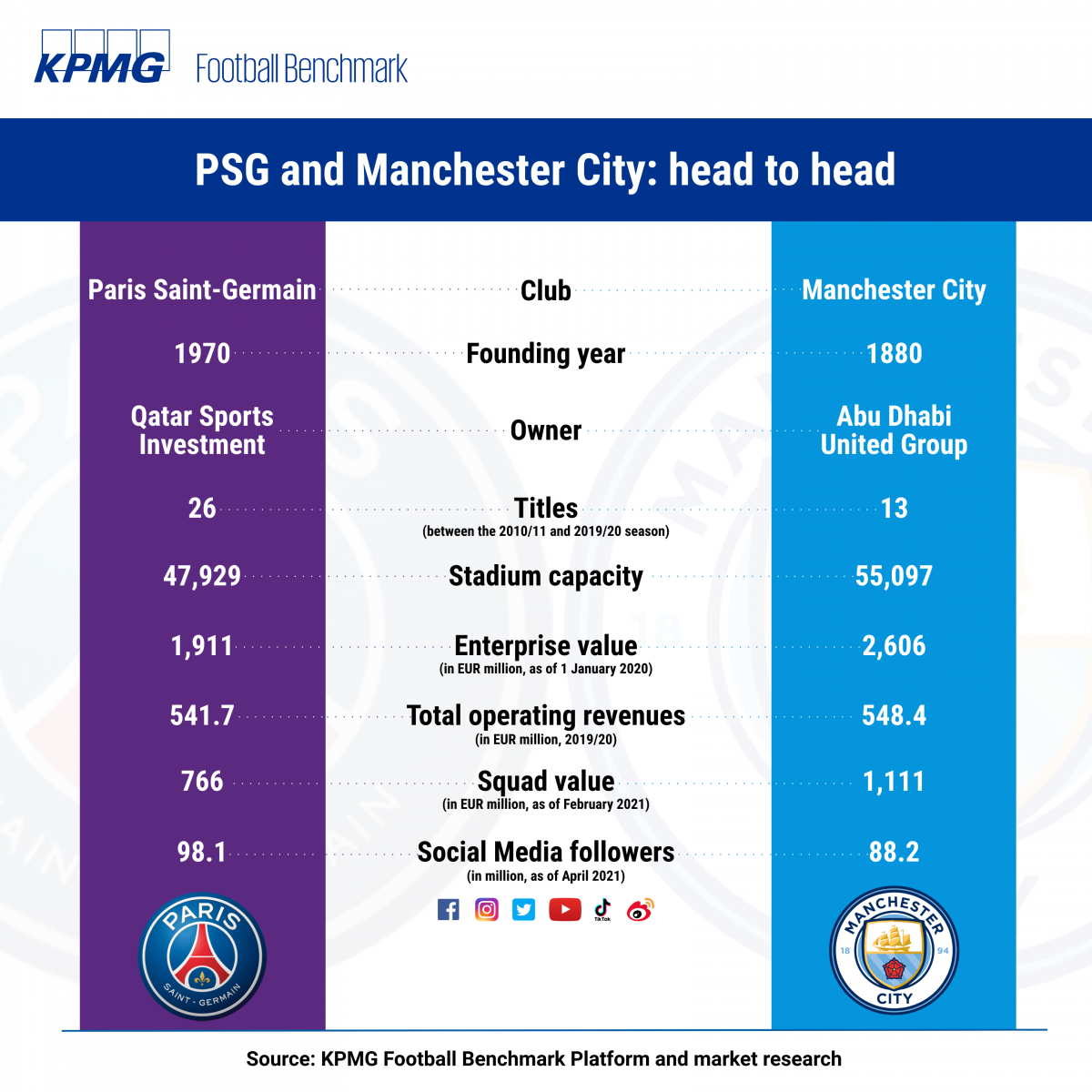

Manchester City FC were founded in 1880 and enjoyed moments of relative success from the 1950’s through the 1970’s both domestically and on the Continent, climaxing in the European Cup Winners' Cup title of 1969/70. However, the club's success had diminished at the start of the new century prior to Sheikh Mansour's and the Abu Dhabi United Group's purchase of the club for GBP 210m in 2008. Significant investments followed immediately, both in playing staff and club facilities, including a GBP 150m investment into the training centre and headquarters. Sporting success followed closely behind: in 2012, four years after the takeover, the club secured their first league title in the Premier League era following a dramatic Sergio Agüero goal in the final minutes of the last game of the season. Since then, they have gone on to win three more league titles, breaking the record in 2017/18 for the most points accumulated in a season. However, Manchester City have yet to conquer the biggest European stage, the UEFA Champions League, reaching the semi-finals only once previously in 2015/16.

Paris Saint-Germain FC, founded in 1970, were in a similar predicament prior to the current ownership's arrival, as they too were attempting to return to previous heights at the dawn of the decade. The club's fortunes changed when Qatar Sports Investments (QSI) purchased an initial 70% of the club in 2011 and finalized the complete buy out in 2012, reportedly valuing the club at EUR 170m. In a move similar to that of Manchester City's owners, the Qatari group swiftly invested in the squad and the facilities, including an extensive renovation of the iconic Parc des Princes stadium. Since the 2012/13 season, PSG have dominated the domestic Ligue 1, winning all but one league titles over an 8-year period (AS Monaco secured the trophy in 2016/17). However, the coveted Champions League glory has eluded them as well, coming closest in the past season, when they reached the final of the competition, only to be beaten by FC Bayern Munich.

Similar objectives but different strategies

While there are abundant similarities in the rise of the two clubs over the past decade, there are also major differences. Manchester City serve as the anchor of a larger group of clubs as part of City Football Group (CFG), which owns 10 clubs around the world, including New York City FC playing in the MLS, Melbourne City FC playing in the A-League of Australia and New Zealand, and an increasing number of club partnerships, too. Obvious synergies can be harvested from this multi-club model from multiple angles. On the commercial side, not only are the clubs in the group's entire portfolio often able to benefit from centrally-brokered commercial deals, but the value of deals themselves are often at a premium, since if a sponsor wants to strike a deal with the anchor club, it will typically have to pay an additional fee to sponsor other clubs in the portfolio too. On the strategic side, by having a clear, unified vision, CFG can partially centralize some operating functions, eliminate redundancies across multiple clubs and transfer knowledge and skills. Finally, Manchester City FC benefit on the sporting side by leveraging the global network of clubs to identify, recruit, develop player talent in addition to intra-group transfers. The success of CFG’s strategy, which certainly presents challenges and requires deep pockets when implemented on a global scale, is considered by many industry experts as the blueprint of building out a multi-club model. Global technology investment firm Silver Lake appeared to agree with this sentiment when it invested USD 500m for just over 10% of the group in 2019, valuing City Football Group at USD 4.8b, according to a statement released by CFG at the time, of which Manchester City FC represented the lion’s share of value.

In contrast, PSG's ownership does not own any other football clubs. Rather than expanding in the football world via a multi-club portfolio, the club's ambition is to diversify its brand outside the restraints of a single sport, developing PSG into a relevant and aspirational brand capable of transcending football through engagement with a wider global audience. Capitalizing on the reputation of its home city Paris - one of the most touristic and iconic cities in the world, a global capital of fashion and a major economy, but without a major football club with a remarkable history - the club set out to turn their brand into a global lifestyle one. Through partnerships with fashion labels, superstar influencers, as well as collaboration with Nike's 'Air Jordan' brand, PSG aim to bridge the gap between sports brands and street fashion, thrusting the brand into new, adjacent and complementary market segments. Furthermore, the club have also grown as a multi-team sports organization, as mirrored by the development of the women's, handball and judo teams.

Investment drives staggering growth

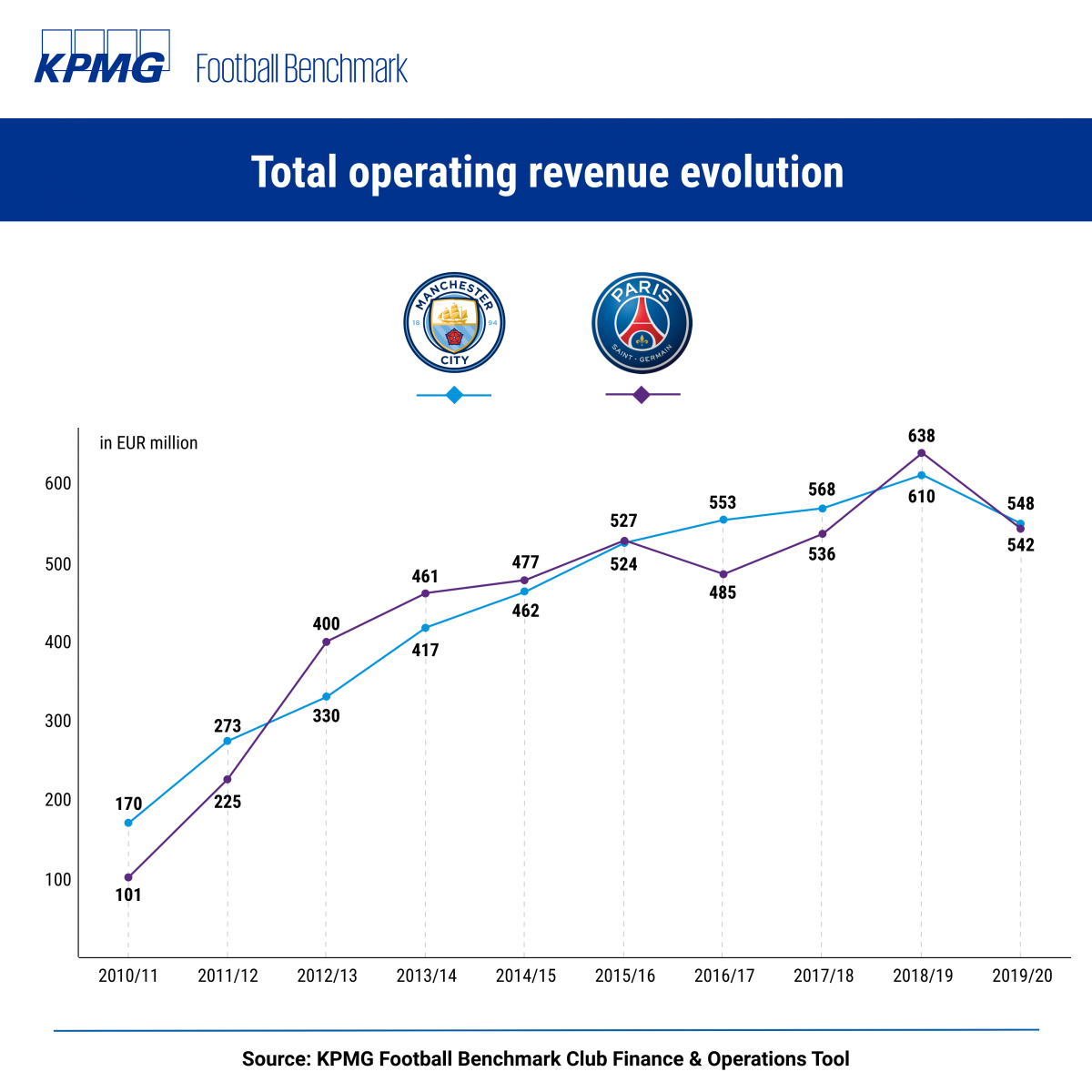

On the financial side, both clubs have evolved rapidly since their takeover. Operating revenues were still only at EUR 104m when the Abu Dhabi United Group purchased Manchester City in 2008. Two years later, in 2010, total revenues had already jumped by 63% to EUR 170m and increased throughout the years to EUR 610m by the end of the 2018/19 season as a result of heavy investment both on and off the pitch, representing a staggering 487% growth since the takeover and 260% since the start of the decade. The 2019/20 season however saw a decline of 10%, down to EUR 548m in revenues due to the global Covid-19 pandemic, as matches were played behind closed doors and broadcasters were paid rebates.

PSG invested heavily into all aspects of the club as well, bringing similar results. The evolution of revenues over the last 10 years perfectly captures the club’s reign under the new ownership. The club was taken over in 2011 when revenues were at EUR 101m, and by the 2018/19 season these figures hit EUR 638m, a 532% increase. In the Covid-impacted past season, PSG experienced a -15% downturn in turnover, recording EUR 542m in total revenues. PSG were affected more deeply by the negative consequences since their domestic league was curtailed, rather than delayed. While the pandemic has rolled back some of the progress, a clear upward trajectory in revenues is still discernible, showing the overall success of the two projects from a revenue growth perspective.

In a comparative analysis of the evolution of the revenues of the two clubs, we have to highlight the fact that Manchester City have benefited over the years from significantly more lucrative domestic and international broadcasting deals negotiated by the EPL in comparison to the ones secured by Ligue 1.

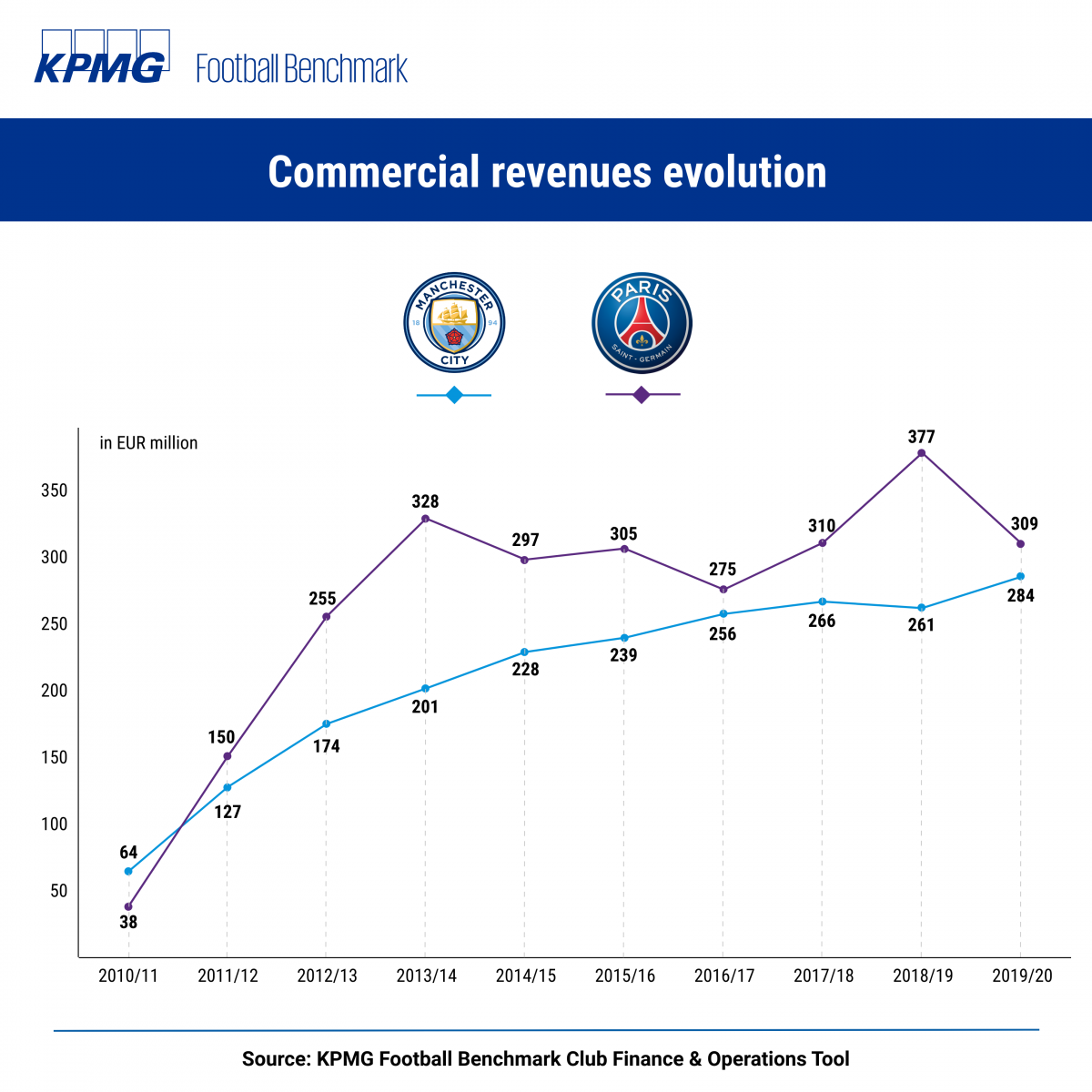

A focus on the commercial revenues, which best represent the benefits attributable to the power of the brand, reveals the main driver behind the large total operating revenue increases. PSG and Manchester City have seen 715% and 344% commercial revenue growth between 2010/11 and 2019/20 respectively. So, what’s behind this commercial growth? The rapid surges are certainly a result of increased sporting achievements over the past decade, elevating both clubs and placing their global following firmly amongst the elite clubs, in turn attracting new and lucrative global sponsorship deals.

PSG’s reported EUR 65m p/a shirt deal with global hotel brand AccorHotels is a case in point and represents the third most lucrative shirt deal for the current football season, after those of Real Madrid and Manchester United, whilst Manchester City’s ongoing shirt sponsorship with Etihad Airways at a reported EUR 51m p/a is currently the 5th most valuable in world football. It is also worth pointing out that both the Accor and Etihad deals of PSG and Manchester City, respectively, are up for renewal later this year. The global pandemic has driven deep cuts for both the hospitality and airline industries, so it remains to be seen whether these organisations have the desire or financial capability to renew their deals beyond 2021.

.png)

However, this is just part of the story. PSG’s lucrative EUR 80m p/a deal with Nike, utilising the company’s ‘Air Jordan’ brand as the kit sponsor, has helped consolidate PSG as a global lifestyle and apparel brand. Through savvy co-branding and celebrity endorsements, PSG can engage with many new customer segments and markets worldwide to drive diversified commercial income streams.

In comparison, Manchester City’s kit supplier deal with apparel brand PUMA is worth EUR 74m p/a, the 5th most lucrative deal of its type globally and a reflection of the club’s growing global brand appeal.

Both clubs are at the forefront of commercial innovation in football, recognising how developments in the media landscape have changed the way fans (especially generation Z) access and consume football and therefore increasing the significance of finding innovative ways to engage and monetise new and existing fans globally. As an example, both clubs were early movers into esports, launching their respective esport teams in 2016 to reach a huge new audience of highly engaged fans in an authentic way. Likewise, PSG are deepening fan engagement and loyalty whilst directly monetising their large global fan base through their launch of 20 million “Fan Tokens”, a digital currency providing access to specific club goods or services.

Commercial deals through companies affiliated or close to the shareholders have also played a significant role in both clubs’ growth in recent years. For PSG, a branding agreement with the Qatar Tourism Authority or commercial deals with Qatar Airways and the Qatar National Bank brought in significant sums of money, while for Manchester City, Etihad Airways becoming the stadium naming rights' sponsor and main shirt sponsor delivered similar results.

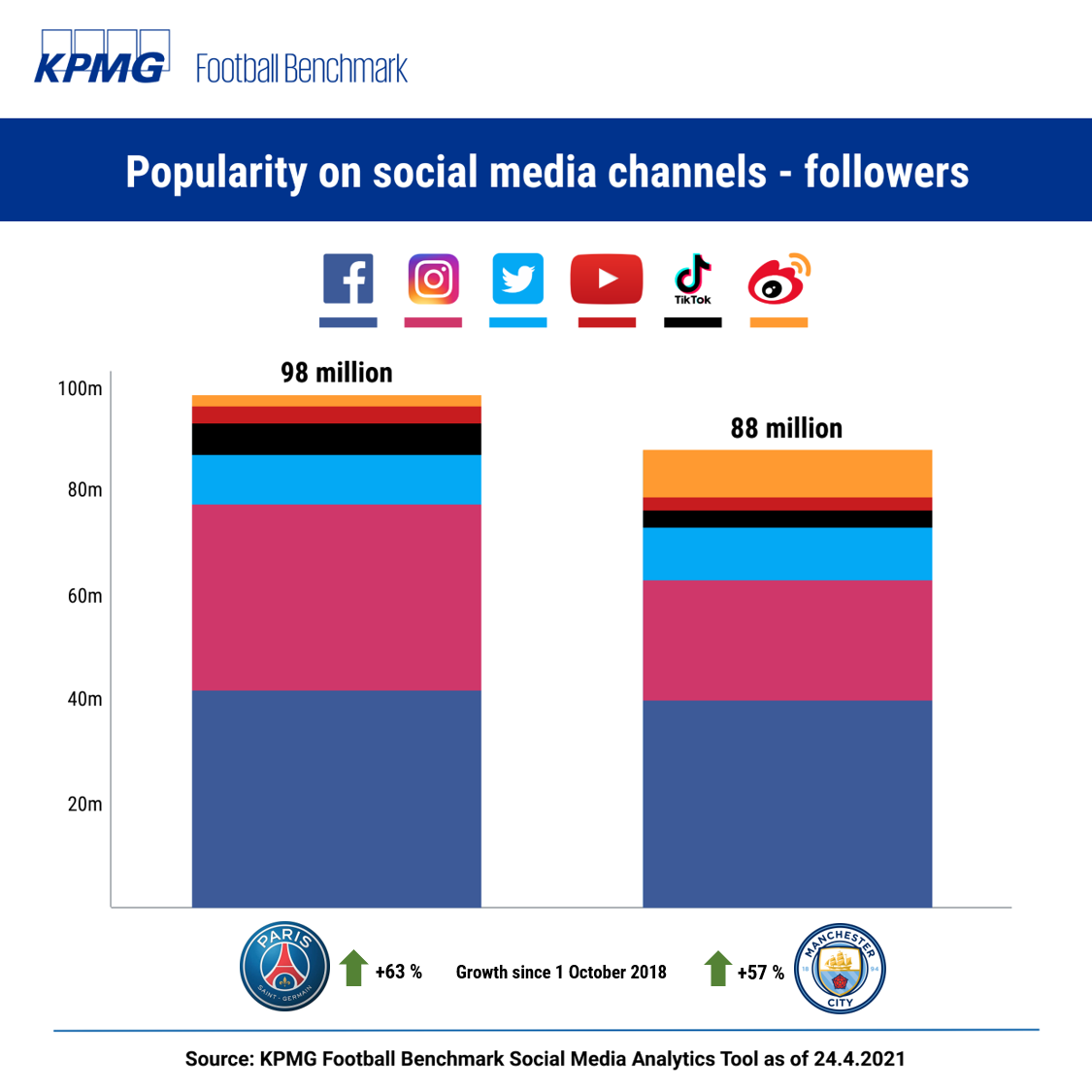

The commercial appeal of both clubs is well-displayed in their global popularity on social channels, with the below chart illustrating the vast number of social media followers worldwide for both clubs. Social media followings of this scale are successfully leveraged by both clubs to attract big-money commercial partners looking to capture greater global exposure and reputation. Of the two clubs, PSG have a superior social media following and two-and-a-half-year social media growth rate, yet it is worth noting that Manchester City’s strategic efforts in China see them far outperforming PSG in terms of Weibo following, one of the most popular platforms in the country. Alternatively, PSG are far superior in terms of Instagram following. This is perhaps no surprise considering the club's brand and marketing activities in fashion and lifestyle, supported by their marque players and famous influencers lend itself to the visually rich content of Instagram.

Financial evolution under scrutiny

Given the dubious nature of some of these sponsoring deals, both Manchester City and PSG have had struggles with UEFA and the Financial Fair Play (FFP) regulations. UEFA implemented a policy according to which revenues from related parties should not exceed 30% of total operating revenues, and these clubs were often balancing on a tightrope around this limit. In 2014, both clubs signed settlement agreements after breaching the break-even rule and were fined EUR 60m, of which EUR 40m was suspended. Furthermore, both clubs' squad size for European competitions was reduced. In PSG's case, sponsorships such as the QTA deal were assigned a new fair value, significantly below that submitted by the club. These sanctions and repeated investigations most likely contributed to PSG's decision to not renew the lucrative QTA deal, which is one of the causes, together with the effect on commercial agreements linked to the suspension of Ligue 1, in the decrease of commercial revenues in the 19/20 season. More recently, Manchester City were provisionally banned from future UEFA competitions for breaches of FFP and Code of Conduct rules relating to an inflated intra-group sponsorship transfer, until the Court of Arbitration for Sport overturned the decision.

Ever-growing staff costs

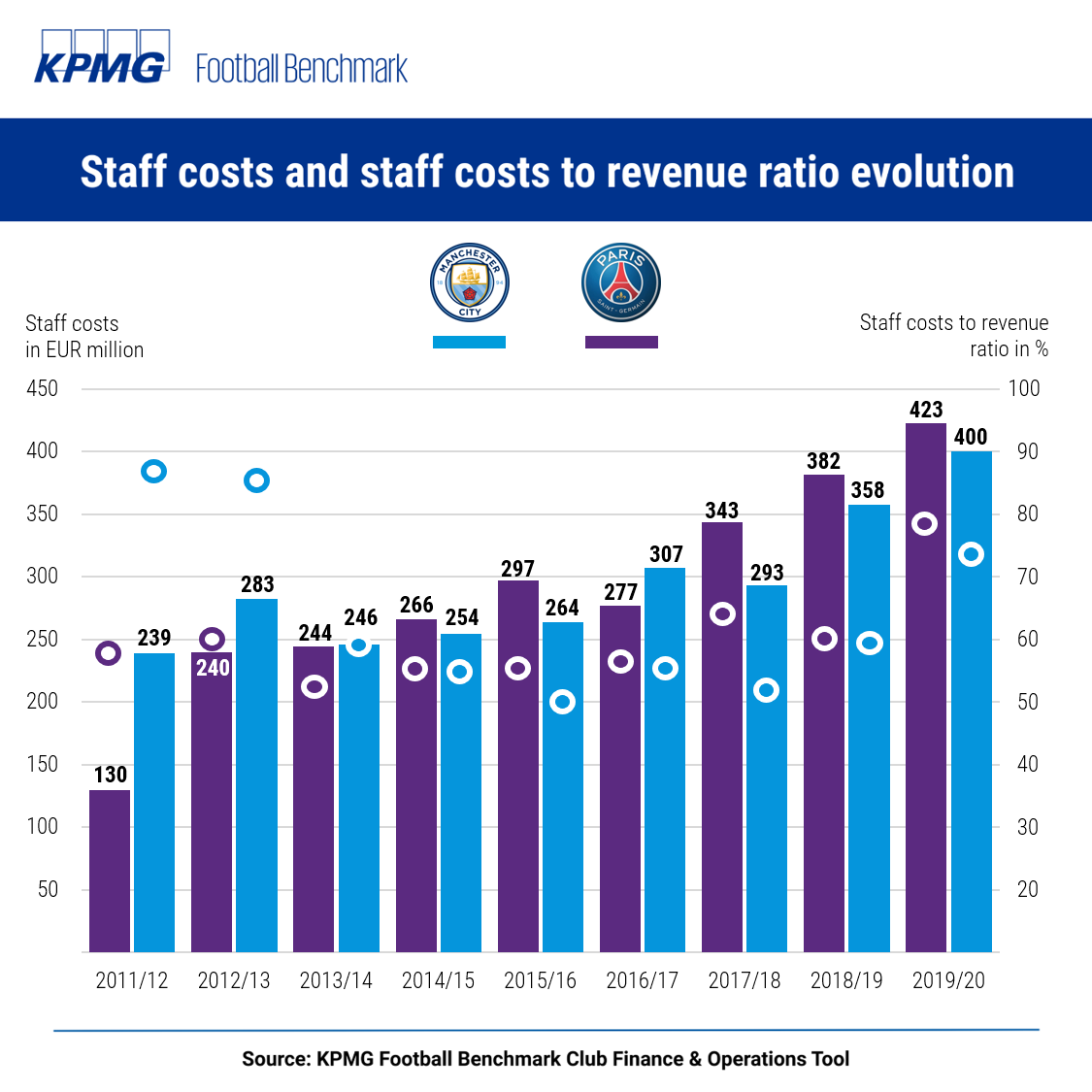

Data from the last nine years show that staff costs have increased dramatically for both clubs as increasing revenues are absorbed by staff expenditures, with relatively small fluctuations also due to sporting performance, naturally because of the extensive investment into playing squads. The chart shows the immediate impact of the PSG takeover, with staff costs increasing by 73% from EUR 130m to EUR 240m in the first season under the new ownership in 2012/13.

Throughout the decade PSG have outgrown Manchester City in this category, due to the global superstars they signed for large transfer fees such as Neymar and Kylian Mbappe. Furthermore, the club have likely paid a premium in wages since the French Ligue 1 is not as appealing as the English or Spanish first division, and social costs for employees are much higher in France than in the other Big 5 countries. At the same time, Manchester City's staff costs have steadily increased as well. In the early years under new ownership, the staff costs to revenue ratios were sky-high at 87% (2011/12) and 86% (2012/13), but the numbers became much more sustainable once revenues caught up to investments into the playing squad.

Transfer expenditure

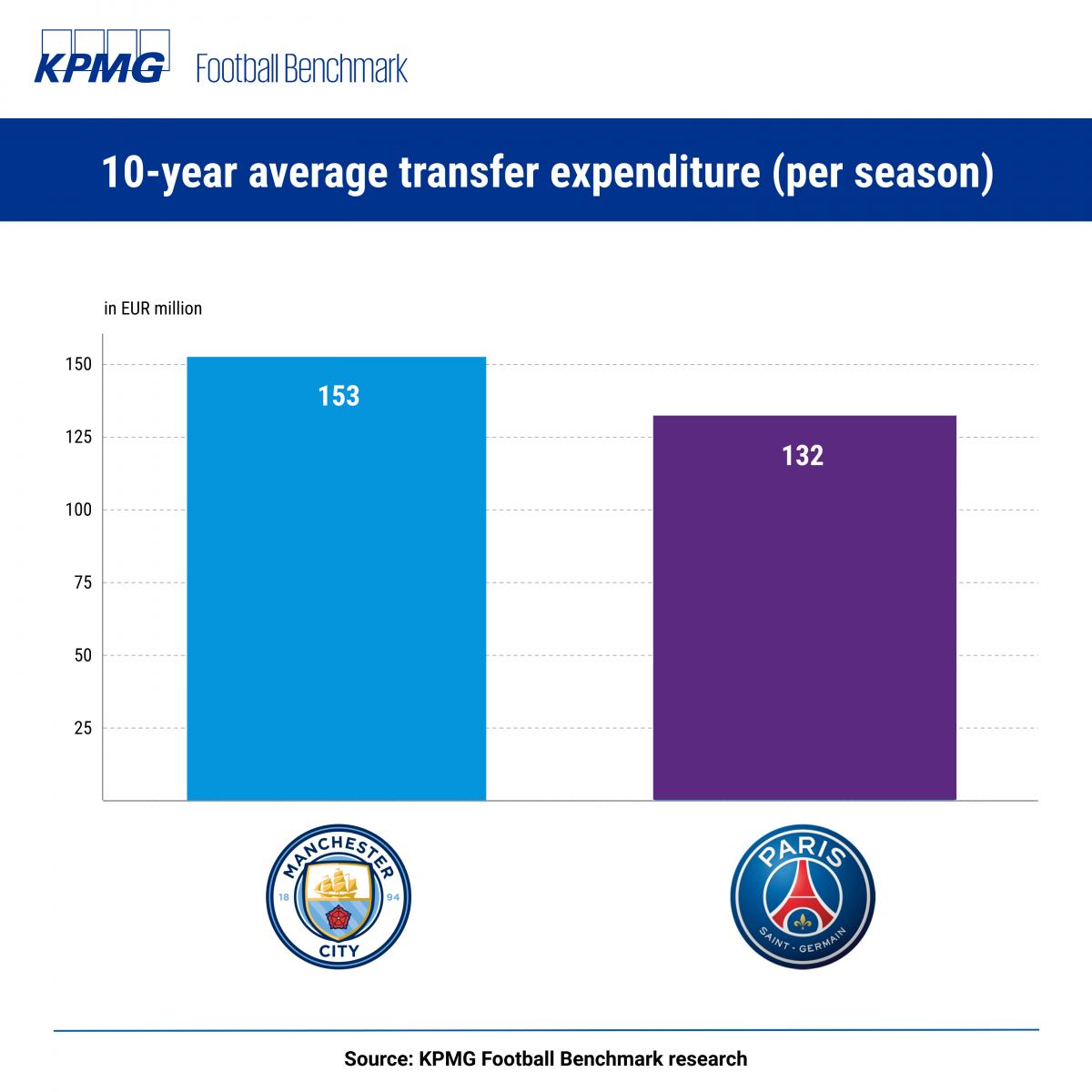

Another aspect of the outlay on the team can be measured by the average transfer expenditure in the past decade. While Manchester City spent more on average per season, they also spent relatively less on their most expensive signings. Indeed, they reportedly paid EUR 76m for Kevin De Bruyne in 2015, who is their record signing to date. On the other hand, PSG spent less on average per season, but they completed two of the most expensive transfers in football when they signed Neymar and Kylian Mbappé for a reported EUR 222m and EUR 180m, respectively.

Evolution of squad values

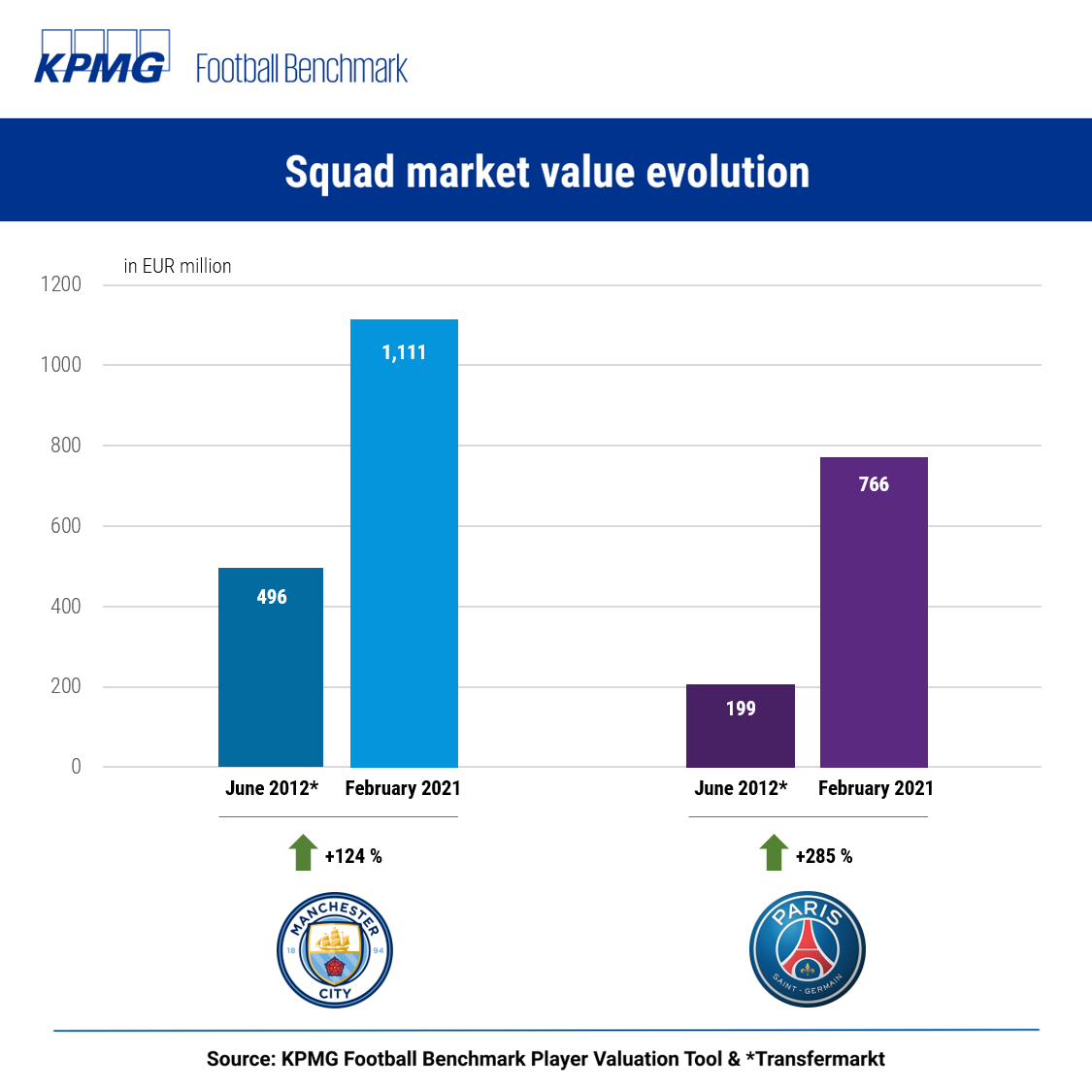

Four years into Abu Dhabi United Group’s ownership of Manchester City, the market value of the squad in 2012 was estimated by Transfermarkt at EUR 496m, more than double the value of the PSG squad, at EUR 199m, in the corresponding season. This not only points to the premium for EPL players compared to those in Ligue 1, but it also illustrates the head start Manchester City had in terms of squad investment over PSG, also in consideration of the earlier acquisition.

From 2012, the year QSI completed the acquisition of PSG, Les Parisiens had grown the value of their squad by a staggering 285% to EUR 766m by February 2021, according to KPMG Football Benchmark’s Player Valuation Tool. This growth was largely driven by the marquee signings of Neymar and Kylian Mbappé, but also dwarfs the growth observed by the Manchester City squad over the same timeframe, at 124%. Having said that, currently, the Citizens (EUR 1,111m), together with Liverpool FC (EUR 1,085m), are the only two clubs in KPMG’s database with a squad value exceeding EUR 1 billion.

Debt status reveals unique financing strategy

Finally, an analysis of net debt[1] demonstrates how differently these clubs are financed compared to other elite clubs. Clubs such as Manchester United FC, FC Barcelona, Tottenham Hotspur FC, and Juventus FC average net debt of approximately EUR 480m according to their financial results from the 19/20 season. Whereas PSG have no interest-bearing debt, in fact, they reported negative net debt of EUR 63m as at June 2020 – namely a surplus of cash – while Manchester City's comparatively small net debt figure of EUR 63m as at June 2020 is almost insignificant next to other similar-sized clubs in Europe, as it also mostly relates to the 250-year leasehold interest in the Etihad Stadium.

Enterprise Value (EV)

Today, both clubs boast being among the top 10 most valuable football clubs. According to KPMG Football Benchmark's latest, pre-Covid club valuation report as at 1 January 2020, Manchester City were the 6th most valuable football club, while PSG were 9th in that ranking. The annual survey also reveals the clubs' enterprise value evolution over the past 5 years. The EV of Manchester City has increased by 61% over this period to reach EUR 2.6bn in 2020, while PSG's enterprise value rose 127% to reach EUR 1.9bn, the fourth-highest growth behind Olympique Lyonnais, Tottenham Hotspur and FC Internazionale. Thanks to such a speedy increase, PSG have been able to significantly catch up with Manchester City’s EV, as the Citizens boast now only a 36% higher EV than Les Parisiens (92% in 2016).

.png)

Conclusion: two football giants with a different strategy and market approach

Both clubs have evolved rapidly in the past decade and are now entrenched amongst not only the biggest football clubs, but amongst the biggest global sports brands as well.

Their influence and power became evident last week when they became key actors in the plans of a break-away European Super League. While initially Manchester City signed up for the movement, PSG stood firm and supported the current European competitions.

This is not the only difference:

- Whilst QSI have chosen to focus their investment in a major global city like Paris, also capitalizing on its powerful brand, and with no rivals, the Emirati investors placed their bet on a relatively secondary city, when compared to the French capital, with a strong competitor as the Red Devils.

- Whilst PSG are focused on a single club development, the City Football Group is pursuing a global multi-club strategy.

Both strategies appear to have led to sporting, commercial and financial success. However, after 13 and 9 years of club ownership for Abu Dhabi United Group (Manchester City) and QSI (PSG) respectively, glory in the 2021 UEFA Champions League competition is the elusive next step to place and consolidate these clubs at the pinnacle of global football.

[1] Net debt is calculated as Current and Long-term interest-bearing loans minus cash at hand. Net debt excludes short- and long-term debt toward clubs, other trade debtors, employees/players, tax authorities and all other debt which is not interest bearing, including shareholders’ loans.