A week-long series of articles on this summer’s major transfers

Three years ago, we assessed the potential benefits Juventus were to reap having signed Cristiano Ronaldo from Real Madrid (The Ronaldo Economics) – in today's analysis, we attempt to calculate the final balance of the investment, taking into account the devastating impact of the coronavirus pandemic.

CR7 shocked the football world when he moved from Madrid to Turin, just as the 5-time Ballon d’Or winner stunned everyone recently by returning to Manchester United FC, where he played between 2003 and 2009 before joining Los Merengues.

In the summer of 2018, Juventus signed Ronaldo for a fee of EUR 116m, the highest transfer fee ever paid by an Italian club, which resulted in an annual amortisation of EUR 29m due to the 4-year contract agreement. According to media accounts, Ronaldo earned an annual net salary of EUR 31m, meaning the club's gross salary expenditure was approximately EUR 57m. That means that Juventus FC, taking into account both annual amortisation and gross salary, bore a total annual cost of EUR 86m for Ronaldo alone, representing approximately 22% of the total operating revenues the club generated at the time he joined (EUR 400m in 2017/18). The overall cost borne by Juventus FC until the date of his departure, taking also into account the EUR 14m loss registered on his disposal this summer - calculated as the difference between the fixed fee paid by Manchester United FC (EUR 15m) and the net book value of Ronaldo as at 30th June 2021 (EUR 29m) is equivalent to EUR 272m over the past three seasons. On the other hand, the EUR 86m savings on the 2021/22 season will represent essential financial relief for the Turin club, which closed the 2019/20 financial year with a net loss of EUR 89.7m and is expecting a more severe loss in the region of EUR 190m for the 2020/21 season. Furthermore, the fixed fee paid by Manchester United FC might be increased, up to a maximum of EUR 8m, upon achievement of specific performance objectives over the duration of the employment contract with the player.

(1).png)

Moving to the revenues side, Ronaldo’s impact was particularly significant on matchday and commercial income, and it would have likely been more conspicuous without the breakout of COVID-19. In particular, stadium revenues grew by 25% in the Portuguese superstar's first season at the Allianz Stadium, from EUR 57.2m in 2017/18 to EUR 71.5m in 2018/19, also thanks to a more expensive ticket price strategy undertaken by club management for non-season tickets, whose price was set before the arrival of CR7. The following two seasons, played partially or almost entirely behind closed doors, caused a significant revenue loss for the Bianconeri.

From a broadcasting perspective, no specific out-turn occurred as Serie A collectively sold its rights for the 2018 – 2021 period just a few weeks in advance of Ronaldo’s arrival, thus unable to reap any sort of boost in its negotiations with interested broadcasters. Unsurprisingly, commercial revenues registered the highest year on year growth at 30%, from EUR 142.6m in 2017/18 to EUR 185.4m in 2018/19. As a testament of the entrenched international appeal achieved by the club after the arrival of CR7, unlike matchday income, the commercial revenue stream didn’t suffer any negative effects from the pandemic, as it remained stable in the 2019/20 season.

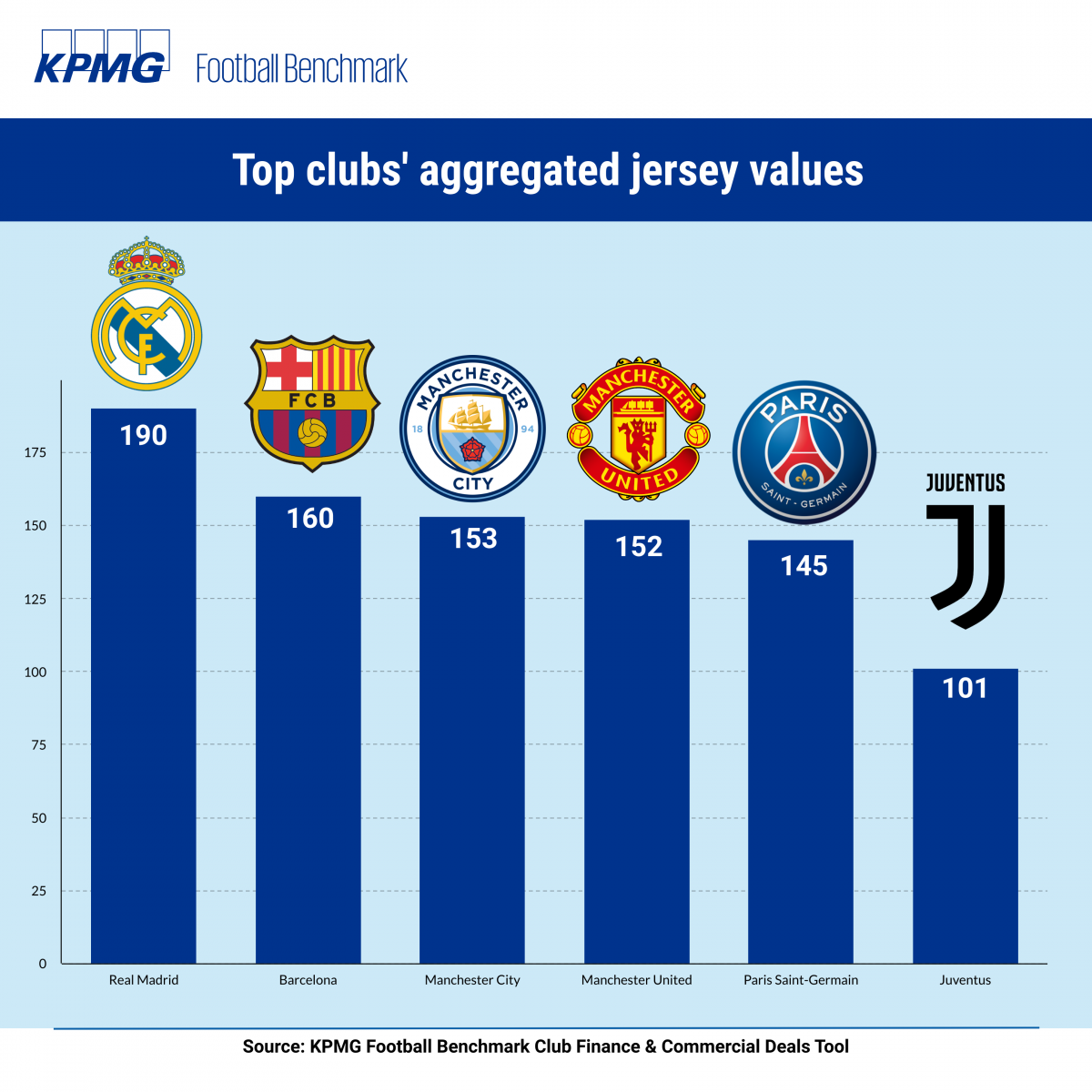

Breaking down commercial revenues, merchandising revenues increased by 58% year on year in 2018/19, reaching EUR 44m – then decreased to EUR 32m in 2019/20 due to limitations on commercial sales and activities due to COVID-19. The commercial upgrade of the club is even more evident by comparing its value of the jersey before and after Ronaldo’s acquisition: EUR 40m vs EUR 101m. Specifically, Juventus FC agreed upon an annual EUR 45m jersey deal with Jeep – from a previous EUR 17m deal – and on a EUR 51m kit supplier contract with Adidas – from an earlier EUR 23m agreement. The increased visibility provided by the Portuguese superstar also facilitated striking a new back-of-shirt deal with retail company Cygames, worth EUR 5m per year.

Our charts displays some top clubs’ income from jersey sponsorships and kit deals.

Another good proxy for understanding the impressive improvement of Juventus FC’s appeal is apparent from the growth of their global digital fan base. Indeed, CR7 helped the club double their social media followers during his spell in Turin: on 9 July 2018, the day before Cristiano Ronaldo’s signature, the club had around 50.4 million followers on their main platforms – while three years later, on 26 August 2021, the day before his return to Manchester United FC was announced, the Old Lady boasted nearly 109 million followers.

With the historical arrival of Ronaldo, Juventus management went “all-in” in order to bridge an existing gap with the European elite. At that time, the club generated EUR 400m in operating revenues, significantly below the likes of Manchester United FC, Real Madrid CF and FC Barcelona – all within a range of EUR 650-750m. While the first season with CR7 showed promising signs, with a 25% growth, the outbreak of the pandemic jeopardised the club’s plans. This strategy was primarily supported by a EUR 175m bond, issued in February 2019, and a capital increase of EUR 300m, finalised in January 2020 just before the COVID-19’s outbreak. The main goal of these liquidity injections was to further support the expansion of the club on a global scale, but they turned out to rather be a key life jacket from the losses caused by the pandemic, with a further EUR 400m capital increase to cushion such damages approved in the recent weeks.

While the financial results of Juventus FC’s investment are somehow ambiguous, from a sporting perspective it is fair to observe that the outcome was poor. One of the key reasons for Ronaldo’s arrival was to allow the club to make the last step on the pitch, following two finals lost in the previous four years, and bring the UEFA Champions League trophy back to Turin. However, the international performance of the club with Ronaldo featuring in the starting line-up was worse than in the previous years without him. Indeed, in the past three seasons Juventus FC were eliminated at the quarter-finals once and at the round of 16 twice, by clubs of lower magnitude, at least on paper, such as AFC Ajax, Olympique Lyonnais and FC Porto.

.png)

Besides the financial risk consciously undertaken by the club, the history of Ronaldo in Turin could also be characterised by unfortunate timing. While it is evident that Juventus FC managed to increase their commercial revenues and international appeal, it is equally apparent that their expansion strategy was aborted by the eruption of the global health crisis, which prevented the club from fully capitalising on the hefty investment. Indeed, such unfavourable circumstances put a dent in Juventus FC’s ability to increase revenues – which after some promising growth diminished, even returning to the starting point of EUR 400m at the end of 2019/20 – and further stressed the club’s finances.