The recent economic announcement offers two layers of interpretation: one celebrates the attained value by the world's most glamorous football league, while the other highlights a halt in growth, at least within the United Kingdom.

The Premier League's announcement of the sale of domestic TV rights can be viewed from two perspectives. Firstly, the immediate reaction celebrates the economic value achieved by the most glamorous football league globally: £6.7 billion for the 2025-29 period from Sky and TNT for live broadcasts, and from the BBC for UK highlights.

At current exchange rates, this translates to €7.8 billion, nearly reaching €2 billion annually and more than doubling Serie A's revenue. For an almost overlapping period, Serie A had sold domestic live rights to DAZN and Sky for €900 million per season (around €15 million for yet-unplaced highlights). The second perspective contextualizes the data, inviting a deeper reflection on the scenario—the flip side of the coin.

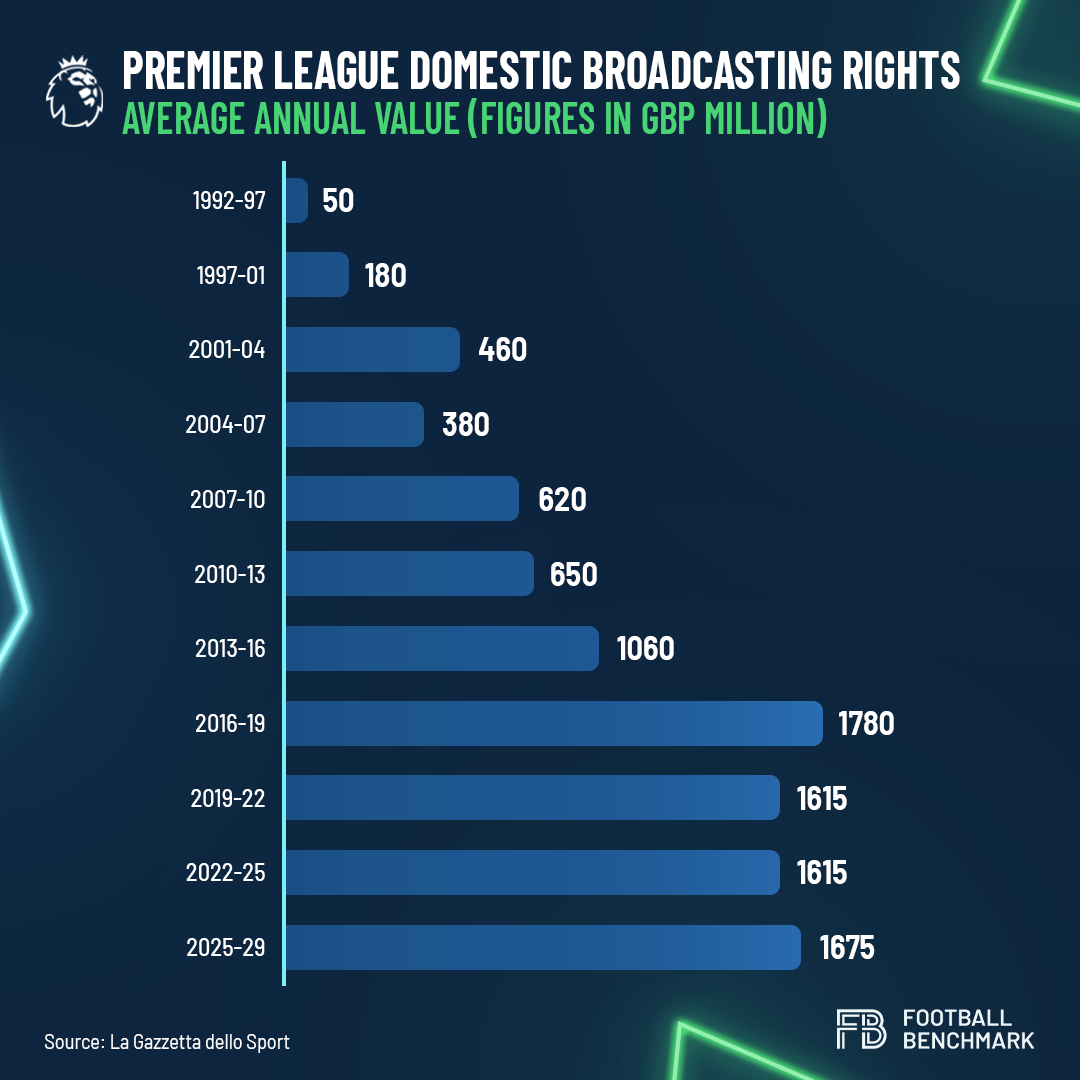

While the Premier League maintains remarkably high levels for its national TV rights and a substantial competitive advantage over other leagues impacting transfer campaigns, the recent selling cycle echoed a trend seen in recent commercialization: the once-rapid growth of the Premier League's TV rights has now stalled, at least within the UK. A look at the historical trend solidifies this observation.

By reasoning in pounds to mitigate currency fluctuations and considering the average annual value of different selling cycles, it's evident that the Premier League's domestic television revenue has stabilized. From the 2016-19 period, where an almost £1.8 billion record per season was reached (a 70% increase from the previous period), to the subsequent 2019-22 period where revenues dropped to just over £1.6 billion despite more games being offered (168 to 200 per season). During the pandemic, the Premier League opted not to risk a new tender, extending existing contracts until 2025. And now, with Sky and TNT Sports maintaining their positions by spending 4% more, while Amazon withdrew and other streaming players like Apple and DAZN opted out, the Premier League secured £1.675 billion per season from the sale of domestic rights. However, to encourage broadcasters’ investments, it extended the offer to four years, one more than the usual three.

Furthermore, starting from 2025, there will be 70 more televised matches per season, marking the first time television coverage includes all matches except for the "protected" Saturday afternoon window. This adjustment implies that the average value of an English league match, concerning UK licenses, will decrease to £6.2 million from the current £8.1 million and the peak of £10.6 million during the 2016-19 cycle. This is a 23% decrease from the last time, despite a 35% increase in content. These figures prompted Luigi De Siervo, CEO of Lega Serie A, to remark, "We are facing a highly complex global situation. The world has paused concerning TV rights, even for the English, who remain at the forefront."

.png)

Indeed, we are witnessing a concerning phase of stagnation across Europe, with some important distinctions. Serie A, after reaching its peak in 2018-21 with €973 million per season from Sky and newcomer DAZN, experienced a setback: €927.5 million in 2021-24, followed by €900 million in 2024-29, a decline that failed to convince the majority of clubs to venture into the Lega's channel. DAZN itself made a significant investment in Spain, displacing Movistar and partnering with Telefonica for La Liga's 2022-27 cycle, witnessing a mere 1% improvement from €980 to €990 million annually. As for Germany, the ongoing domestic cycle until 2025 was awarded to Sky and DAZN for the pay section, totaling €4.4 billion (€1.1 billion annually), slightly lower than the €4.64 billion of 2017-21. The Bundesliga's return to the market next year will shed light on its future.

And what about Ligue 1? It had hoped for success with Mediapro, which briefly inflated the value of French domestic rights to €1.153 billion per season for the 2020-24 cycle, up from €726 million for 2016-20. However, the Spanish group failed to deliver. For the 2021-24 period, Amazon stepped in, covering some losses, but the actual income (including Canal+) was slightly below €600 million per season, well below pre-Covid levels. The 2024-29 auction was deserted, making Ligue's goal of €800 million seem like a distant dream as they engage in challenging private negotiations.